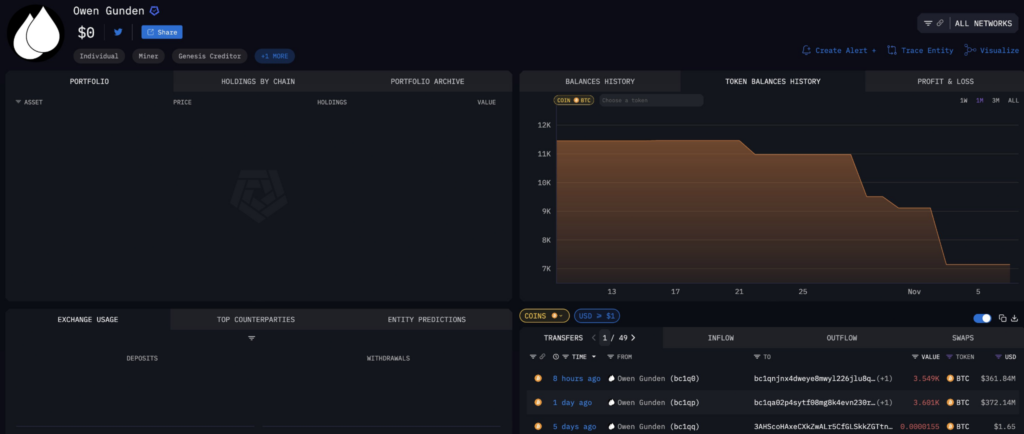

As Bitcoin (BTC) struggles to maintain its price above the $100,000 mark, on-chain data indicates that the asset is likely to experience more volatility, especially considering that a long-term holder identified as Owen Gunden might be preparing to sell.

Analysis of his transactions shows that Gunden transferred his remaining 3,549 BTC, valued at approximately $361.84 million, from his primary wallet.

Notably, 600 BTC, worth about $61.17 million, has already been deposited to the crypto exchange Kraken, a move often seen as preparation for selling, according to Arkham data retrieved on November 9.

The remaining funds are sitting in an unspent address, possibly awaiting further transactions.

Crypto whale Bitcoin transaction. Source: Arkham

Crypto whale Bitcoin transaction. Source: ArkhamThis comes just a day after another major transfer on November 8, when Gunden moved 3,600.55 BTC valued at $372 million, with 500 BTC ($51.68 million) already sent to Kraken.

In total, over the past two days, the whale has moved more than 7,100 BTC, bringing his total offloaded amount in recent weeks to roughly 11,000 BTC, equivalent to $1.12 billion at current prices.

Possible impact on Bitcoin price

Such large-scale movements of Bitcoin to centralized exchanges typically indicate an intention to sell, which can weigh heavily on market sentiment. Whale dumps of this magnitude tend to increase selling pressure, potentially leading to short-term corrections in Bitcoin’s price as liquidity absorbs the sudden influx of supply.

If Gunden proceeds with selling his remaining holdings, Bitcoin could face intensified volatility in the coming days, especially as traders and algorithms react to the on-chain signals of a possible billion-dollar liquidation.

Indeed, this selling pressure comes as Bitcoin struggles to make a notable move above the $100,000 mark, briefly correcting below that level earlier this week.

Besides macroeconomic factors, the asset has also been weighed down by massive institutional exits through exchange-traded funds (ETFs). Over the past week, the spot Bitcoin ETFs shed almost $2 billion, one of their steepest weekly declines since the products launched.

By press time, Bitcoin was trading at $102,009, having made a modest correction of 0.5% in the past 24 hours. On the weekly timeline, the asset is down over 8%.

Featured image via Shutterstock

The post Major whale signals dumping over $1 billion of this crypto appeared first on Finbold.

4 hours ago

1036

4 hours ago

1036

English (US)

English (US)