![Why Crypto Is Crashing Today [Live] Updates On Dec 1,2025](https://image.coinpedia.org/wp-content/uploads/2025/12/01134215/Why-Crypto-Is-Crashing-Today-Live-Updates-On-Dec-12025-1024x536.webp)

The post Crypto News Today [Live] Updates On Dec 1,2025 : Crypto Crash, Bitcoin ATM,21 Share XRP ETF,Ethereum Price appeared first on Coinpedia Fintech News

December 1, 2025 08:44:16 UTC

Bitcoin Dips on Monthly Open as Low Liquidity Triggers Algorithmic Sell-Off

Bitcoin slipped at the start of the new month as algorithms kicked in and pushed the price lower. Liquidity remains thin after many market makers were wiped out during the heavy volatility on October 10. Despite the drop, nothing has changed in Bitcoin’s structure. It was simply rejected from a key resistance level and is now moving sideways in a consolidation phase. Analyst Michaël van de Poppe expects Bitcoin to retest this resistance in the next 1–2 weeks and possibly break toward $100K.

December 1, 2025 07:39:46 UTC

Bitcoin Price Trades Near $87K as ETF Flows and Fed Bets Influence Market

Bitcoin is trading around $87,178 after a recent correction from $90,364. Market sentiment remains neutral as traders weigh expectations of Federal Reserve rate cuts against weak ETF flows. Spot ETFs recorded $70 million in inflows, though BlackRock’s ETF saw outflows. Turkmenistan legalized Bitcoin trading for 2026, adding regulatory support. BTC faces resistance near $91,570 with key support at $86,945. Analysts note miner behavior is positive, but on-chain data signals caution. Ranging price action suggests traders watch for a breakout above $91,570 or a drop below $86,945.

December 1, 2025 07:26:15 UTC

XRP Futures Show Major Flush-Out, Speculator Appetite Cools

XRP’s futures open interest has dropped sharply, falling from 1.7 billion XRP in early October to 0.7 billion XRP, marking a ~59% flush-out. Funding rates have also plunged, from around 0.01% to 0.001% (7-day SMA), signaling reduced speculative pressure. Analysts say October 10 marked a structural pause in aggressive upside bets, reflecting cautious sentiment among traders. This correction in futures positioning could stabilize XRP’s market and set the stage for more measured price action in the near term.

December 1, 2025 07:17:17 UTC

Bitcoin Price Poised for Major Move as Liquidity Tsunami Hits Markets

Bitcoin could be set for a significant rally in the coming months. Analysts note a strong correlation between BTC and global liquidity, with price typically lagging 8–10 weeks behind major liquidity injections. Currently, BTC is digesting September’s liquidity while China pumps trillions via MLF and the Fed ends QT on December 1. This suggests the market hasn’t fully priced in November–December liquidity. Historically, such conditions signal BTC, IBIT, and MSTR may be undervalued, potentially setting the stage for a strong January–February acceleration.

December 1, 2025 07:07:03 UTC

Top 7 News That caused Crypto Crash Today

Crypto markets endured a brutal week as a perfect storm hit. Bitcoin dropped below $100K for the first time since June amid $1.37B in liquidations. The Fed cast doubt on a December rate cut, slashing odds and triggering risk-off. DeFi suffered a $128M Balancer hack, while AI tech stocks erased $820B in value. Trump’s 155% China tariff threat, the longest US government shutdown, and $1.15B in ETF outflows added to pressure. Analysts warn of continued volatility but see December as a potential rebound window.

December 1, 2025 07:01:22 UTC

Crypto “Crash” of $130B Is Just a Leverage Flush, Not Real Losses

The recent $130 billion drop in crypto market capitalization isn’t real capital loss—it’s a classic leverage flush. High funding rates, crowded long positions, and thin weekend order books triggered a chain reaction, pulling BTC, ETH, SOL, and XRP down simultaneously. Just a few hundred million in aggressive selling can mathematically erase over $100 billion in market cap. Analysts say this is a healthy reset, clearing overstretched positions, with prices expected to stabilize and rebound once excess leverage is flushed from the market.

December 1, 2025 06:59:49 UTC

Top Crypto News and Key Trends to Watch Today

Markets are showing mixed signals as 2025 nears its end. Bitcoin’s Fear & Greed Index climbed to 28, while the Altcoin Season Index sits at 35. Polymarket shows an 87% chance of a December Fed rate cut. Coinbase premium turned positive, and $NVDA now exceeds the market cap of most countries. On-chain, $AAVE V4 and $FLUID V2 mainnets went live, and wallets remain top revenue generators in DeFi. Short-term crypto moves remain uncertain, but analysts remain bullish on medium- and long-term trends.

December 1, 2025 06:52:58 UTC

BOJ’s 1% 2-Year Yield Signals End of Zero Rate Era

Japan’s 2-year bond yield reaching 1% highlights a potential end to the long-standing zero interest rate environment. For decades, yen borrowing costs were nearly zero, fueling global carry trades. Now, with markets pricing in possible BOJ hikes, Japanese investors may pull funds back home, tightening global liquidity. While this shift could influence Treasuries, currencies, and risk assets, analysts warn that Japan may revert to easier policies if a global downturn hits, keeping deflation fears in check.

December 1, 2025 06:47:06 UTC

Japan’s 2-Year Yield Hits 1% for the First Time Since 2008

Japan’s 2-year government bond yield has climbed to 1%, the highest level since 2008. This marks a major shift for a country long accustomed to near-zero interest rates. Investors now see a real chance of another Bank of Japan rate hike in December, signaling a move away from the era of free short-term yen money. The rise affects global liquidity, weakens carry trades, and could influence risk assets and currency flows worldwide.

December 1, 2025 05:55:32 UTC

Ethereum Price Prediction, Ahead of Key Events Next Week

Ethereum is consolidating around the $3,000 mark with limited weekend price action, but next week could bring volatility. Key events include the end of QT and Fed Chair Powell’s speech on December 1, followed by the Fusaka upgrade on December 3. If ETH holds above $3,000, it may push higher toward the $3,200–$3,400 zone. Conversely, failing to maintain this level could see a pullback toward $2,800. Traders are closely watching these catalysts for potential price movements.

December 1, 2025 05:54:41 UTC

This Week’s Key Economic Events to Watch for Market Moves

This week is packed with major economic releases that could influence markets. On Monday, the focus is on November’s ISM Manufacturing PMI and a speech from Fed Chair Powell. Tuesday brings September’s JOLTS Job Openings data. Wednesday is busy with November’s ADP Nonfarm Employment, S&P Global Services PMI, and ISM Non-Manufacturing PMI. Thursday sees Initial Jobless Claims data, while Friday wraps up with September’s PCE Inflation and December’s Michigan Consumer Sentiment data. Traders should watch these closely for potential market-moving insights.

December 1, 2025 05:53:06 UTC

Ripple News: XRP Follows Bitcoin as Late Sunday Sell-Off Hits Market

Despite recent talk of a supply shock and speculation that XRP is decoupling from Bitcoin, the market experienced a typical late Sunday dip. XRP’s price moved in line with Bitcoin, showing that short-term correlations remain intact. Traders note that while narratives around XRP independence are gaining attention, immediate market behavior still reflects Bitcoin’s influence. The sell-off highlights that, for now, XRP remains sensitive to broader crypto market trends, even as long-term growth and adoption stories continue to develop.

December 1, 2025 05:51:57 UTC

XRP News: Ripple Gets MAS Approval to Expand Payments Across Singapore

Ripple has secured approval from Singapore’s Monetary Authority (MAS) to expand its payment activities under its Major Payment Institution (MPI) license. This allows Ripple to offer fully licensed, end-to-end payment services across Singapore, one of the world’s leading fintech hubs. The move marks another step in Ripple’s global expansion strategy, strengthening the XRP ecosystem and enabling broader adoption of its payment solutions. Analysts see this as a major boost for Ripple’s presence in Asia and its continued fintech growth.

December 1, 2025 05:51:02 UTC

Bitcoin Starts December by Sweeping Downside Liquidity Ahead of FOMC

Bitcoin’s start to December shows healthy market structure. The Sunday pump didn’t materialize, the CME gap has already closed, and around $400 million in long liquidations have been taken out. Traders note that downside liquidity was cleared first, setting the stage for a potential base formation. Nearly $2 billion in shorts sit between current levels and $92.5K, while $13 billion lie up to $103K. Analysts see this as a favorable setup ahead of the FOMC and year-end, as Bitcoin forms a higher low.

December 1, 2025 05:49:23 UTC

Why Did Bitcoin Price Crash?

Bitcoin’s latest selloff isn’t driven by crypto-specific news but by a major shift in global markets. Japanese bond yields are spiking, with the 2-year hitting its highest level since 2008, and the Yen is surging. Traders now see a 76% chance of a Bank of Japan rate hike on December 19. Higher Japanese rates and a stronger Yen are forcing an unwind of the carry trade, pushing investors out of risk assets like Bitcoin and into safe havens such as gold. Volatility is expected to remain high.

December 1, 2025 05:48:04 UTC

Altcoins Poised to Outperform Bitcoin as QT Stays on Pause

Altcoins may be entering a strong multi-year window of outperformance against Bitcoin. Historically, whenever the Federal Reserve was not running quantitative tightening, altcoins outpaced BTC with 42-month and 29-month uptrends seen in 2014–2017 and 2019–2022. Analysts highlight a tight correlation between crypto markets and the Fed’s balance sheet, suggesting that if QT remains inactive, liquidity conditions could favor higher-beta assets. This trend points to a potentially long period where altcoins outperform Bitcoin once again.

December 1, 2025 05:46:03 UTC

Bitcoin Price Drop as Rising Yields Trigger Leverage Flush Across Crypto

Bitcoin is selling off as macro conditions and heavy positioning collide. Japanese 2-year bond yields moved above 1% for the first time since 2008, signaling the Bank of Japan may tighten after years of cheap money. That shift pushed global risk assets lower, and BTC — being high beta — was hit first. The initial drop cracked support, triggering stops and liquidating crowded long positions. As exchanges forced into thin liquidity, the move accelerated. The reaction shows Bitcoin trading more like a macro-sensitive asset than a safe haven.

December 1, 2025 05:42:09 UTC

Chainlink Set for Big Milestone as First Spot ETF Launches This Week

Chainlink is gearing up for a major moment in the crypto market. Nate Geraci, President of The ETF Store, revealed on X that the first spot Chainlink ETF is expected to launch this week. He added that Grayscale will upgrade its current Chainlink private trust into a publicly tradable ETF. This move could make Chainlink more accessible to everyday investors and bring fresh attention to the project as ETF interest continues to grow.

December 1, 2025 05:42:09 UTC

Bitcoin Price Crash Weekly Chart Signals Trouble

Bitcoin’s monthly and weekly candles are set to close with clear signs of weakness. The monthly chart failed to hold key support, while the weekly candle is now bear-retesting the breakdown level. After shifting from bearish at $110K to bullish at $84K, some traders say the structure is turning bearish again around $91K. Many are choosing to step aside, closing positions and waiting for either a clean move above $100K or a deeper pullback before re-entering the market.

December 1, 2025 05:40:36 UTC

Bitcoin Price Prediction This Week

Bitcoin’s monthly candle is closing with a key bullish signal. The price briefly dipped to its long-term trendline but bounced back above it, showing strong demand at a critical level. This is the same trendline that previously sparked 175% and 118% rallies in past cycles. As long as BTC holds above it, the higher-timeframe uptrend remains intact. If it loses this level, the structure could shift. For now, buyers stepped in, and the next monthly candle should confirm the market’s direction.

December 1, 2025 05:38:43 UTC

Why Bitcoin Price is Dropping?

Bitcoin is dropping sharply ahead of today’s emergency Federal Reserve meeting, with large sell orders reportedly coming from major players, including Binance, Wintermute, and BlackRock. In just three hours, more than $2.5 billion in BTC is said to have been offloaded, adding intense pressure to the market. The aggressive selling has fueled speculation about coordinated moves and insider activity, though none of the firms have made public statements. Traders are now watching the Fed meeting closely as volatility continues.

December 1, 2025 05:37:34 UTC

Crypto Crash Today : Bitcoin and Altcoins Dropping

Bitcoin suddenly fell $5,000 within hours, wiping out nearly $210 billion from the crypto market. More than $700 million in positions were liquidated, despite no major news, macro events, political issues, or even FUD driving the move. Traders say the sharp drop looks like a classic leverage reset, with whales dumping price to flush out overextended positions. The sudden volatility has sparked renewed debate about market manipulation and the growing influence of large holders during high-leverage periods.

December 1, 2025 05:25:09 UTC

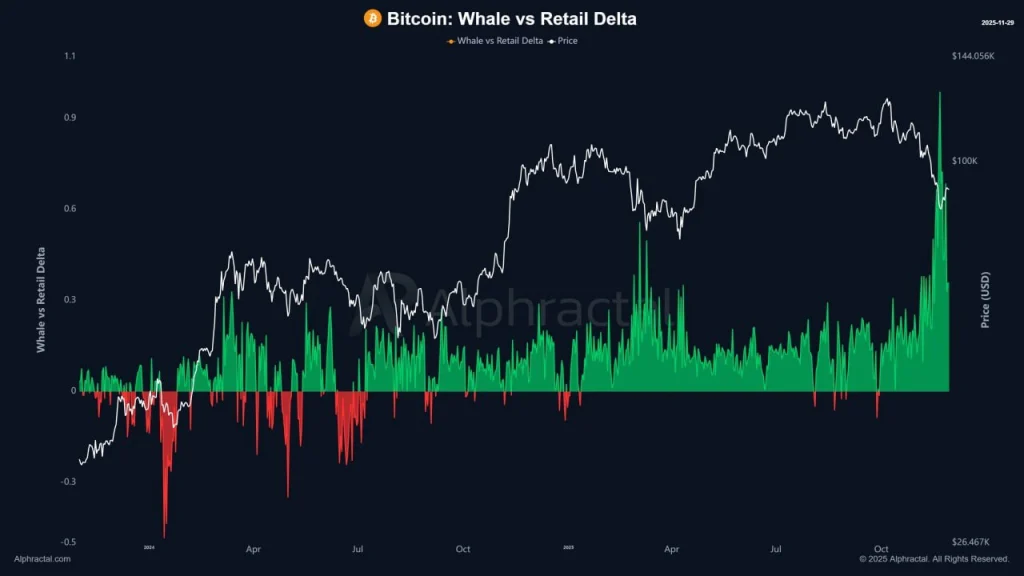

Whales Turn Cautious as Retail Traders Fuel Bitcoin FOMO

Whales appear to be reducing their long Bitcoin positions or quietly adding to shorts, even as retail traders jump in out of FOMO. This kind of setup often leads to sideways movement, as happened in March and April. Some bearish traders are also watching the $80,000 zone again, possibly preparing to accumulate if the price dips back into that range.

1 hour ago

216

1 hour ago

216

English (US)

English (US)