Key takeaways

- Chainlink could reach a maximum value of $26.03 in 2025.

- By 2028, LINK could reach a maximum price of $86.67.

- In 2031, Chainlink is expected to range between $204.98 and $253.01.

The chainlink platform emerged as a prominent player in the cryptocurrency market. It provides a secure, decentralized oracle network that connects smart contracts with real-world data, influencing the current price. As the adoption of decentralized finance (DeFi) and blockchain technology continues to grow, Chainlink’s innovative solutions have attracted significant attention from investors and traditional financial institutions alike.

Chainlink continues to expand its reach and utility across the blockchain ecosystem, showcasing its robust integration capabilities and promoting enterprise adoption across various sectors through its cross chain interoperability protocol . Recent updates highlight 14 new integrations of 5 Chainlink services across 10 different blockchain platforms, demonstrating its versatility across multiple blockchains, including prominent names like Arbitrum, Avalanche, and Ethereum. These integrations enhance Chainlink’s network and solidify its position as a critical player in the interoperability and functionality of decentralized applications.

Understanding Chainlink’s potential price movements based on the information presented is crucial for making an investment decision. It involves analyzing various factors, including market trends, technological advancements, partnerships, and overall market sentiment. This Chainlink price prediction aims to provide insights into its future performance by examining technical analysis and fundamental aspects that could influence its value.

Overview

| Cryptocurrency | Chainlink |

| Token | LINK |

| Price | $13.06 |

| Market Cap | $10.28B |

| Trading Volume (24-hour) | $1.56B |

| Circulating Supply | 696.84M LINK |

| All-time High | $52.88, May 09, 2021 |

| All-time Low | $0.1263, Sep 23, 2017 |

| 24-hour High | $13.51 |

| 24-hour Low | $13.03 |

Chainlink price prediction: Technical analysis

| Metric | Value |

| Price prediction | $ 16.44 (+9.91%) |

| Price Volatility (30-day variation) | 10.27% |

| 50-day SMA | $19.67 |

| 14-day RSI | 32.67 |

| Sentiment | Bearish |

| Fear & Greed Index | 23(extreme fear) |

| Green days | 14/30 (47%) |

| 200-day SMA | $ 17.94 |

Chainlink price analysis: Bears maintain control

- Sellers remain dominant as LINK trades below its midpoint and struggles against strong overhead supply.

- The daily trend shows continued downside pressure with lower highs and persistent difficulty breaking key resistance levels.

- The 4-hour chart confirms a tight downward channel, leaving LINK vulnerable unless buyers reclaim higher pivot levels.

On November 29, 2025, Chainlink (LINK) trades at $13.06, down 2.27% over the past 24 hours, signaling sustained downward pressure. The token moved between $13.03 and $13.51, showing limited volatility as trading stayed below the $13.2467 midpoint. Sellers maintained control through the later sessions, keeping sentiment cautious as price action shifted into the red zone.

Chainlink 1-day price chart: LINK holds key support as downtrend pressure builds

The daily chart shows LINK trading just above key support at $13.00, a level buyers continue to defend despite weak momentum. A failed breakout at $13.50 shifted the structure downward, pushing the price back under the $13.20 pivot. LINK now remains in a corrective phase, with sellers maintaining pressure until a breakout above this zone occurs.

LINK/USDT Chart: TradingView

LINK/USDT Chart: TradingViewFurther daily chart readings show weakening bullish momentum as sell volume increased and the green zone faded after midday. Sellers took full control around 6:00 PM, pushing LINK into a steady red-zone decline and forming a pattern of lower highs. Indicators such as the RSI slipping toward neutral-lower levels and MACD showing bearish convergence support the downtrend bias. A retest of $13.00 remains likely unless buyers reclaim the $13.20–$13.25 zone with stronger volume.

Chainlink 4-hour price chart: LINK consolidates within a tight downward channel

On the 4-hour chart, LINK is trading within a tight compression pattern as it struggles to break above the declining resistance line. Multiple rebound attempts stalled below $13.20, confirming strong overhead supply, while support at $13.03 remains the key level to watch. Momentum indicators are fading, suggesting continued range-bound movement unless volume increases.

LINK/USDT Chart: TradingView

LINK/USDT Chart: TradingViewThe 4-hour chart shows that LINK is forming a mild downward channel as volatility declines, reflecting a seller-favored structure. Each recovery attempt has been capped by resistance, and buyers must reclaim the intraday pivot to shift sentiment, leaving LINK vulnerable to further pressure near the lower end of its 24-hour range.

Chainlink technical indicators: levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 18.29 | SELL |

| SMA 5 | $ 18.09 | SELL |

| SMA 10 | $ 18.39 | SELL |

| SMA 21 | $ 17.72 | SELL |

| SMA 50 | $ 19.67 | SELL |

| SMA 100 | $ 20.95 | SELL |

| SMA 200 | $ 17.94 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 18.37 | SELL |

| EMA 5 | $ 19.43 | SELL |

| EMA 10 | $ 20.99 | SELL |

| EMA 21 | $ 21.97 | SELL |

| EMA 50 | $ 20.92 | SELL |

| EMA 100 | $ 19.05 | SELL |

| EMA 200 | $ 17.65 | SELL |

What to expect from Chainlink?

On November 29, 2025, Chainlink (LINK) trades at $13.06, down 2.27% over the past 24 hours, signaling sustained downward pressure. The token remains below its daily midpoint of $13.2467, moving within a narrow range of $13.03 to $13.51 as sellers maintain control.

On the daily chart, LINK is holding just above key support at $13.00, defended by buyers despite weakening momentum. A failed breakout at $13.50 pushed the price back under the $13.20 pivot, keeping LINK in a corrective phase, with indicators such as the RSI slipping toward neutral-lower levels and MACD showing bearish convergence.

The 4-hour chart shows LINK consolidating in a tight downward channel, facing repeated resistance near $13.20 while support at $13.03 remains crucial. Momentum is fading, and further range-bound or downward movement is likely unless buyers reclaim the $13.20–$13.25 zone with strong volume. Overall, sellers dominate both daily and intraday charts, leaving LINK vulnerable to further pressure toward $13.00 unless a decisive breakout occurs.

Is Chainlink a good investment?

On November 29, 2025, Chainlink (LINK) trades at $13.06, down 2.27%, as sellers maintain control below the $13.2467 midpoint. The token holds support at $13.00 but faces repeated resistance near $13.20, with lower highs forming and momentum fading. The 4-hour chart shows a tight downward channel, signaling continued downside risk. Unless buyers reclaim $13.20–$13.25 with strong volume, LINK remains vulnerable to further pressure toward $13.00, suggesting caution for short-term investors.

Why is the LINK price down today?

Chainlink (LINK) is down today, trading at $13.06, as sellers maintain control below the daily midpoint of $13.2467. The token faces strong overhead resistance near $13.20, while support at $13.00 is being tested. Lower highs and fading momentum, confirmed on both daily and 4-hour charts, indicate continued downside pressure. LINK remains in a corrective phase within a tight downward channel, and repeated failed breakouts at $13.50–$13.20 have strengthened bearish sentiment. Unless buyers reclaim the $13.20–$13.25 pivot with strong volume, further decline toward $13.00 is likely, which explains the token’s weakness today.

Recent news

Chainlink, the leading decentralized oracle network, has partnered with FTSE Russell, one of the world’s largest index providers, to bring FTSE Russell’s benchmark index data on-chain via DataLink, Chainlink’s institutional-grade data publishing service.

Will Chainlink reach $50?

Based on long-term forecasts from industry experts, Chainlink (LINK) is projected to reach $50 by 2027, The Chainlink forecast indicates potential future price movements as its ecosystem and user adoption continue to grow.

Will Chainlink reach $100?

Chainlink can reach $100 by 2029, This aligns with real world asset tokenization according to expert predictions, indicating a potential turning point.

Does Chainlink have a promising long-term future?

Chainlink shows signs of stabilization and potential for recovery, indicating that the token may have a bullish case and promising long-term future within the blockchain industry.

Chainlink price prediction November 2025

For November 2025, Chainlink is primed for notable growth, according to the latest link price prediction . The minimum projected trading price is $22.83, with an average of around $23.94 for LINK tokens, relative to the current Chainlink price. LINK is expected to attain a peak price of $25.07.

| Chainlink Price Prediction | Potential Low | Average Price | Potential High |

| Chainlink Price Prediction November 2025 | $22.83 | $23.94 | $25.07 |

Chainlink (LINK) price prediction 2025

The market price for LINK is expected to reach a maximum of $21.62 in 2025. However, traders can expect a minimum trading price of $10.83, which is influenced by the overall market capitalization and external data sources. The average price of Chainlink is expected to be $19.52.

| Chainlink Price Prediction | Potential Low | Average Price | Potential High |

| Chainlink Price Prediction 2025 | $10.83 | $19.52 | $21.62 |

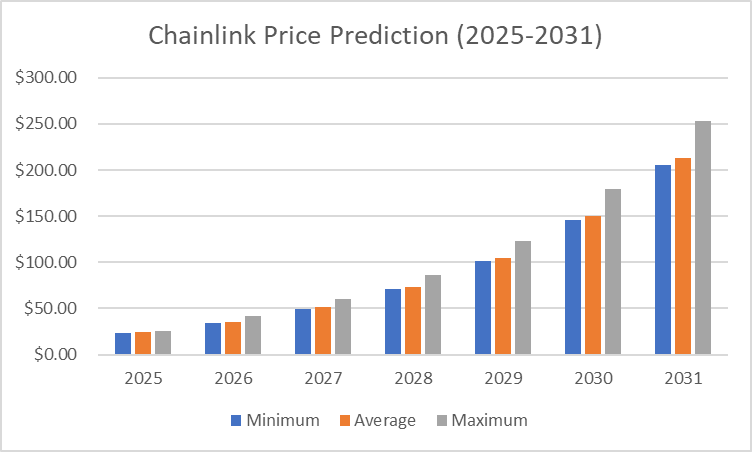

Chainlink price prediction 2026-2031

| Year | Minimum | Average | Maximum |

| 2026 | $34.50 | $35.48 | $41.50 |

| 2027 | $49.77 | $51.55 | $60.05 |

| 2028 | $70.68 | $72.74 | $86.67 |

| 2029 | $101.02 | $104.66 | $123.36 |

| 2030 | $145.35 | $150.58 | $179.58 |

| 2031 | $204.98 | $212.51 | $253.01 |

Chainlink price prediction 2026

In 2026, Chainlink is expected to reach a maximum value of $41.50, a minimum price of $34.50, and an average value of $35.48.

Chainlink price prediction 2027

In 2027, LINK’s average price is expected to be $51.55; its minimum and maximum trading prices, reflecting its historical performance, are predicted to be $49.77 and $60.05, respectively.

Chainlink price prediction 2028

The price of Chainlink is predicted to reach a minimum level of $70.68 in 2028. If the price continues to rise, it may be a good time to buy link, as LINK can reach a maximum level of $86.67 and an average price of $72.74.

Chainlink price prediction 2029

The Chainlink price prediction for 2029 suggests a minimum price of $101.02, a maximum price of $123.36, and an average forecast price of $98.86, taking into account the total crypto market capitalization.

Chainlink price prediction 2030

In 2030, Chainlink prediction expects LINK to reach a maximum value of $179.58, a minimum price of $145.35, and an average value of $150.58.

Chainlink price prediction 2031

The price of Chainlink is predicted to reach a minimum value of $204.98 in 2031. If the bulls hold, it may be a good opportunity to buy Chainlink, as investors can anticipate a maximum cost of $253.01 and an average trading price of $212.51.

Chainlink Price Prediction 2025-2031

Chainlink Price Prediction 2025-2031Chainlink market price prediction: Analysts’ LINK price forecast

| Firm Name | 2025 | 2026 |

| DigitalCoinPrice | $32.36 | $37.73 |

| CoinCodex | $29.78 | $68.54 |

Cryptopolitan’s Chainlink price prediction

According to our Chainlink price forecast, the coin’s market price might reach a maximum value of $21.62 by the end of 2025. In 2026, the value of LINK could surge to a maximum cost of $41.50.

Chainlink’s historic price sentiment

Chainlink price history: Coinmarketcap

Chainlink price history: Coinmarketcap- Chainlink launched at around $0.20 and remained under $1 throughout 2018, with moderate market cap growth. In 2019, LINK had substantial growth, reaching $1 in May and peaking around $3 by year-end, driven by its utility in providing reliable data feeds for smart contracts.

- 2020 marked a breakout year as LINK surged from $2 to $20 by August, fueled by DeFi demand. In 2021, it reached an all-time high of around $52 in May but dropped to $22 by mid-year due to market volatility.

- In 2022, LINK ranged between $15 and $25 amid broader market corrections. In 2023, it further declined, stabilizing in the $6 to $13 range as investor sentiment cooled.

- Starting 2024 at $15, LINK briefly spiked to $18 in February before falling to $12 by April. The coin’s price has fluctuated throughout 2024, peaking near $15 in May, dropping to around $10 by August, and stabilizing between $10 and $12.28 in October. In November, LINK is trading within the range of $10.68 to $11.94. In December, LINK maintained a range of $18.43 to $30.94.

- In January 2025, Chainlink peaked at $22.90 but lost momentum towards the end of the month, leading to a trading range of $19.20-$21.00 in February.

- In March 2025, Chainlink (LINK) experienced a strong upward trend, starting at approximately $13.73 and steadily rising to $16.02, with periods of volatility.

- In April, Chainlink (LINK) showed relatively stable price movement, fluctuating between $10.7 and $15.3, indicating volatility within a broad trading range.

- In May, Chainlink (LINK) began trading at approximately $14.20 and experienced some price fluctuations, dipping to a low of $13.90. According to the latest data, the price has slightly recovered and is currently around $14.06, exhibiting mild volatility.

- Chainlink (LINK) fluctuated between $11.50 and $15, experiencing a sharp mid-June dip but essentially stabilizing around $13.10 by early July.

- In August, Chainlink (LINK) traded in the price range of approximately $15.8 to $16.6, with its latest price reaching $16.6 on August 4th.

- The Chainlink (LINK) price ranged between a high of $23.19 and a low of around $22.20, currently trading at $22.71 as of September 2025.

- In October 2025, Chainlink traded around $22.6, showing strong recovery momentum compared to its earlier lows in previous years.

- The Chainlink shows the asset trading between $13.75 and $15.25 from November 4–5, 2025, ending at $14.67 after a volatile 24-hour period.

English (US)

English (US)