XRP erased nearly $19 billion in market value over the past seven days, falling from $147.08 billion on 12 November to just $128.50 billion today, according to CoinMarketCap tracking. While the broader crypto market showed slight recovery during the same period, XRP struggled to hold its ground, hinting at growing weakness beneath the surface.

XRP 7-day market cap chart. Source: CoinMarketCap

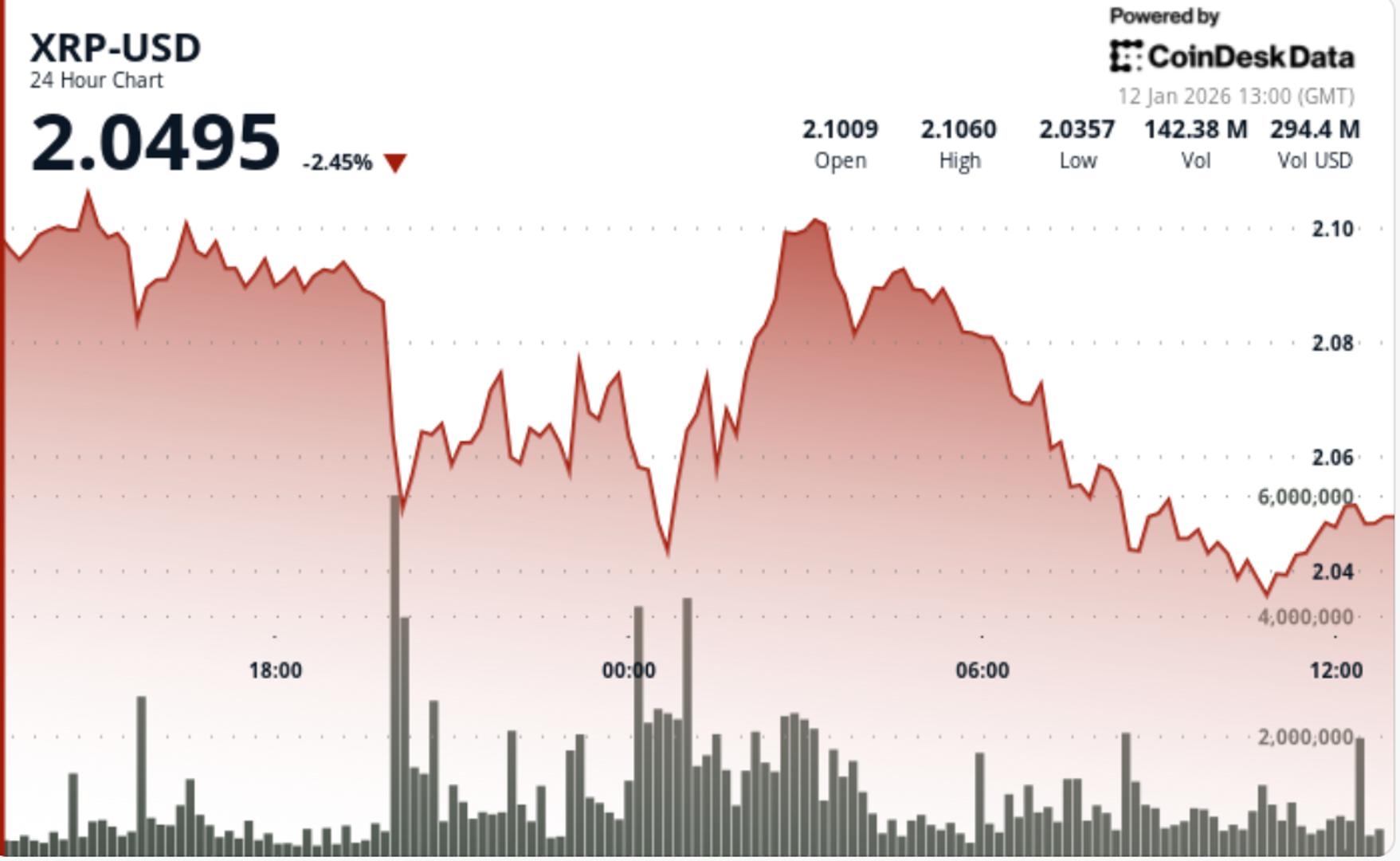

XRP 7-day market cap chart. Source: CoinMarketCap Over the past 24 hours, XRP dropped 1.6% to $2.14, underperforming the wider digital asset market, which saw a modest 0.24% gain. This divergence points to softening investor sentiment, particularly after the recent momentum driven by ETF optimism lost steam.

XRP 7-day price chart. Source: Finbold

XRP 7-day price chart. Source: FinboldMarket pullback drags XRP below $2.15

Unlike other major cryptocurrencies that have stabilised following the recent correction, XRP continued to slide. The failed attempt to hold above the $2.19 pivot point prompted several traders to unwind positions, signalling that upside attempts are currently lacking conviction.

While the token briefly benefited from increased investor interest around ETF announcements, that enthusiasm has not translated into sustained buying pressure. Instead, price action suggests the market may be entering a corrective phase.

On-chain XRP data reveals declining confidence

Fresh profitability metrics show that just 58.5 percent of XRP supply is currently in profit, marking the lowest level in twelve months. This is significant because, despite strong year-on-year performance, a large portion of tokens was bought during more optimistic phases of 2025 and is now held at a loss.

In practical terms, weaker profitability often leads to hesitation among new buyers and increased caution from long-term holders. As a result, sell-side pressure may intensify if the market fails to stabilise.

Losing the $2.19 level puts focus on $2.08 support

Following the breakdown at $2.19, traders are now watching $2.08, which aligns with the 78.6 percent Fibonacci retracement level. A hold above this area could help XRP consolidate before attempting a rebound. However, a daily close below $2.08 may accelerate losses toward the psychological $2.00 level, with even deeper downside risk if sentiment deteriorates further.

That said, a recovery above $2.25 would be the first positive signal, suggesting that bearish pressures are easing. It would also improve the probability of XRP retesting previous resistance zones.

XRP volume slide highlights cooling institutional interest

The token’s 24-hour trading volume currently stands at $4.68 billion, down 35 percent from last week. Combined with declining market cap, this suggests that institutional investors and high-volume traders may be stepping back rather than averaging into weakness.

While the short-term decline does not necessarily indicate long-term trend breakdown, fading activity often precedes extended consolidation or further retracement.

Moving forward, market participants will be paying close attention to the weekly close. Holding above $2.08 remains essential to maintain structural integrity. A breakdown below this level could see XRP retest $1.80, or possibly revisit mid-2025 demand zones. Conversely, a decisive move back above $2.25 would start to invalidate current bearish structure and may attract fresh positioning from momentum-driven traders.

As market analyst Ali Martinez highlights:

“Below $2.15, the next key XRP levels are $1.91 and $1.73.”

His view aligns with the broader technical picture, suggesting that a breach of current support could expose the asset to deeper retracement.

The post XRP wipes out $19 billion from its market cap in a week appeared first on Finbold.

1 month ago

7858

1 month ago

7858

English (US)

English (US)