In an unexpected turn, President Donald Trump has set the global stage ablaze with his recent tariff propositions. His aggressive tariff tactics, especially towards China and India, might dramatically influence global trade and, consequently, the financial markets. Insight from the Financial Times reveals the potential imposition of a hefty 100% tariff demand on these nations, which Trump wants the European Union to lead. The ramifications of this sweeping initiative present a compelling narrative as they unravel.

Will Sanctions End the Ukraine Conflict?

Trump’s envisioned solution involves sanctions aimed at swiftly resolving the Ukraine crisis. This strategy, reportedly under discussion, has gained momentum as Russia’s advances seem to have stagnated. Echoes from the Financial Times suggest a “leaked” account of Trump’s recommendations, amid growing expectations of impending punitive measures.

He aspires for the European Union to spearhead these massive tariffs on China and India, emphasizing the potential benefits. “The President voiced today that one of the clearest paths is for us to uphold impactful tariffs until China agrees to halt oil imports,” disclosed one insider.

Can Tariffs Curb Russian Ambitions?

This intriguing proposal emerges as Russian President Vladimir Putin recently announced plans to export 100 billion cubic meters of gas to China, challenging the U.S. stance. This development intensifies an already precarious geopolitical landscape.

The ongoing scenario poses substantial challenges. Russian efforts toward conflict resolution are minimal, and dialogs have faltered. Meanwhile, Russia taunts international reactions by boosting energy exports to China, exacerbating hostilities.

What potential outcomes could arise? Both the EU and the U.S. may contemplate additional collective tariffs. Despite efforts from China and India to mediate, Russia remains resolute, potentially escalating tensions. Persisting aggravations could dangerously edge toward a global conflict, as Trump modifies defense policies akin to World War II strategies.

Bullet points:

- 100% tariffs targeting China and India are seen as strategic leverage.

- Continued Russian defiance heightens geopolitical risks.

- Potential collaborative tariffs between the EU and the US are under consideration.

- China-India diplomatic efforts observed in the backdrop.

- Implications of these tensions possibly leading to a broader conflict.

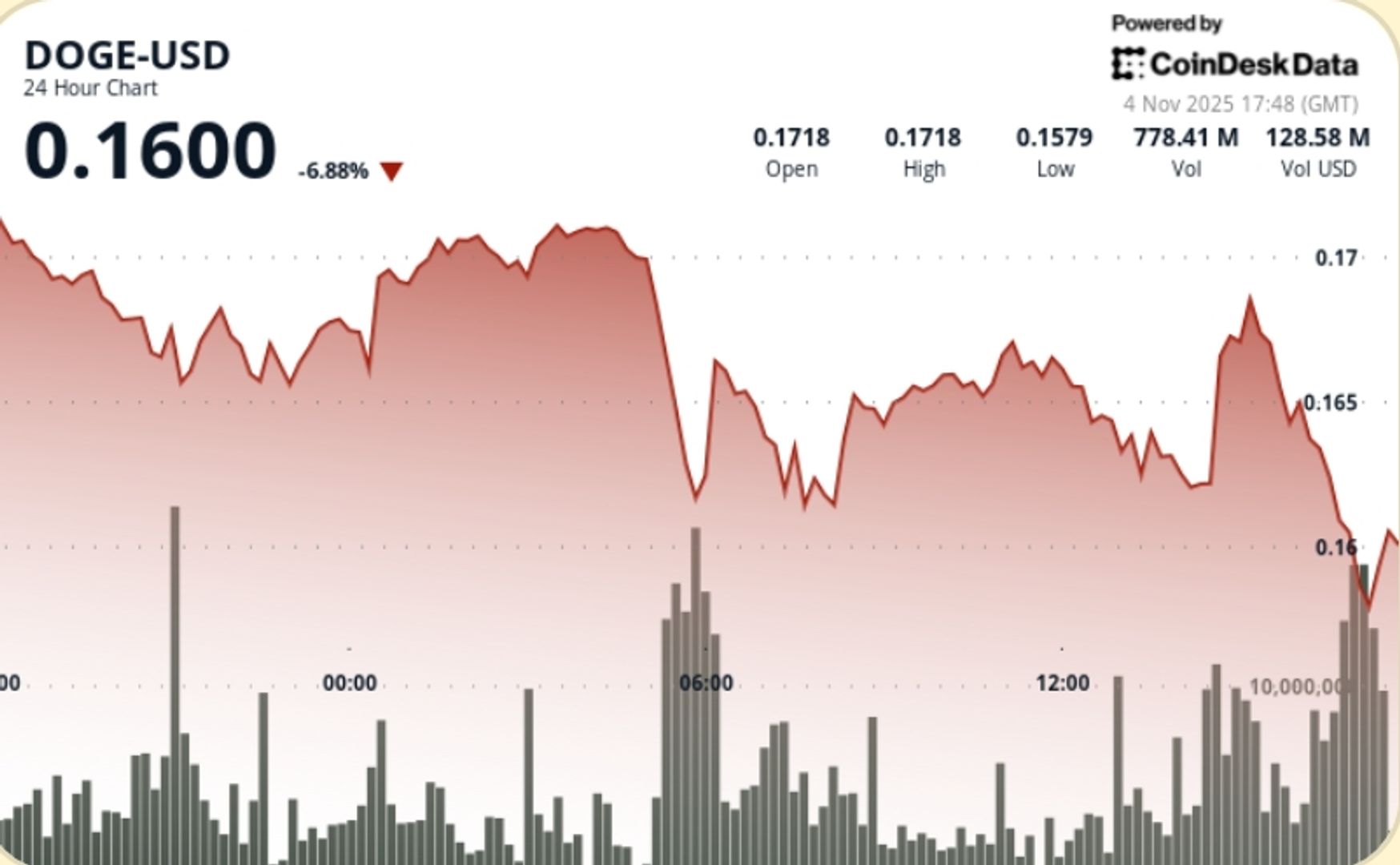

With such geopolitical disarray, the cryptocurrency markets brace for turbulent times, reflecting the broader economic concerns.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.

English (US)

English (US)