The cryptocurrency market faced a brutal sell-off on October 21, with over $110 billion in market value wiped out in a matter of hours. The total market cap plunged from around $3.75 trillion to $3.64 trillion, as panic selling swept across both Bitcoin (BTC) and major altcoins.

Crypto market cap price chart. Source: CoinMarketCap

Crypto market cap price chart. Source: CoinMarketCapBitcoin slid 3.07% in 24 hours to trade at $107,580, underperforming the broader crypto market’s decline of 2.96%. Despite holding the key $107,000 support level, the benchmark crypto has now logged a 30-day drop of 6.74%.

Bitcoin 1-day price chart. Source: Finbold

Bitcoin 1-day price chart. Source: FinboldAltcoins were hit even harder. Ethereum (ETH) tumbled 4.67% to $3,860, BNB (BNB) shed 5.13% to $1,067, while Solana (SOL) slumped nearly 5% to $184. XRP fell 2.71% to $2.40, extending losses after recent ETF speculation cooled.

Why is the crypto market crashing?

The sell-off comes against the backdrop of the ongoing U.S. government shutdown, now in its third week, which has paralyzed the SEC. With more than 90 crypto ETF applications, including Solana and XRP funds, frozen in limbo, institutional inflows have dried up.

Latest data shows Bitcoin ETF inflows fell to $146.18 billion, down sharply from $159.48 billion last week, eroding one of the asset’s strongest demand drivers.

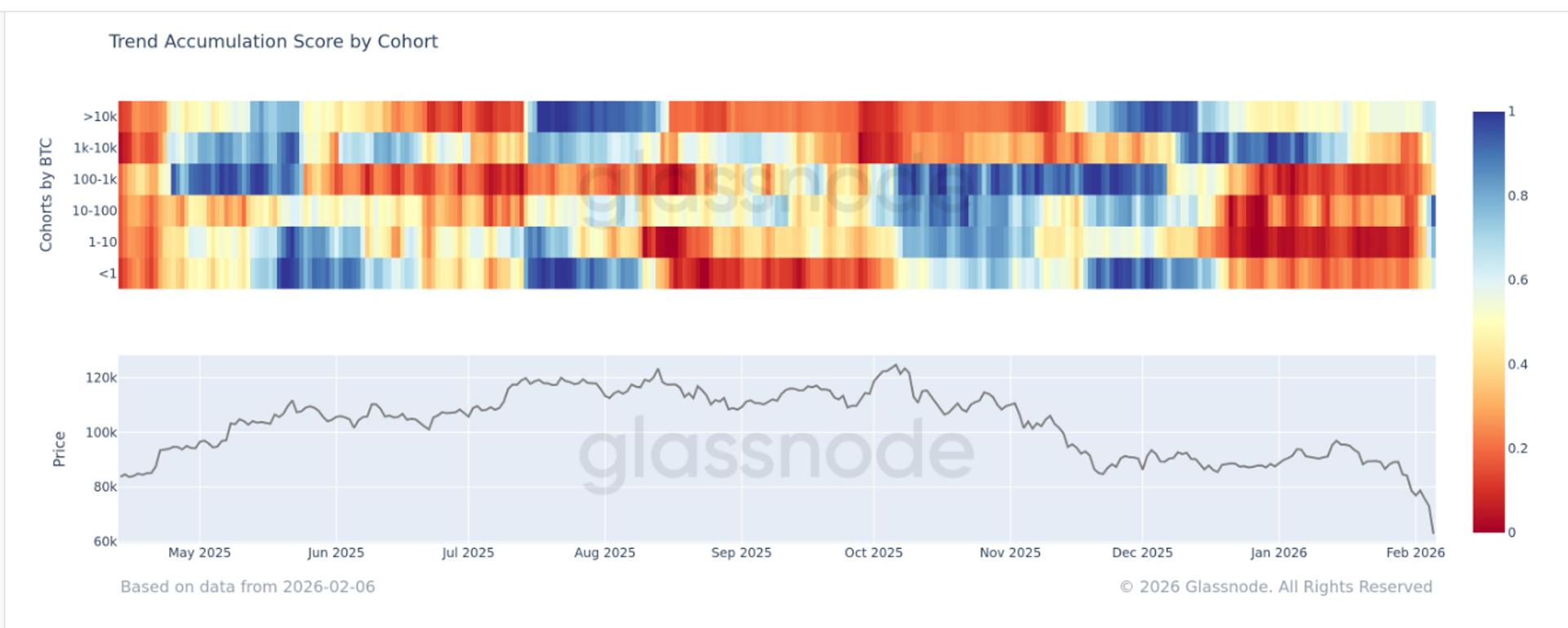

On-chain signals also point to profit-taking. CryptoQuant data highlights that long-term Bitcoin holders wallets holding BTC for over a year, reduced their supply by 0.8% in October, offsetting institutional accumulation.

This dynamic has created a supply overhang, as veteran investors lock in profits while ETF demand alone fails to absorb the selling pressure. Yet Bitcoin’s ability to cling to $107,000 underscores ongoing institutional dip-buying at lower levels.

What’s next for Bitcoin?

The key battle is around $107,00 support. A decisive break lower could see Bitcoin tumble to $105,000, sparking broader deleveraging across altcoins. Traders are closely monitoring two catalysts. One, a U.S. government shutdown resolution, a restart of SEC operations would revive ETF approval timelines. Second, whether institutional demand returns strongly enough to absorb profit-taking by long-term holders.

For now, the market remains on edge, with the Fear and Greed Index at 33 (Fear), reflecting investor caution as macro and regulatory headwinds collide with fragile market sentiment.

The post Why is the crypto market crashing today? $110 billion erased in hours appeared first on Finbold.

3 months ago

36849

3 months ago

36849

English (US)

English (US)