The post U.S. Government Shutdown Delays Crypto Market Structure Bill, Triggering Bitcoin and Ethereum Sell-Off appeared first on Coinpedia Fintech News

The U.S. government shutdown has created significant obstacles for the passage of a comprehensive crypto market structure bill, which aims to clarify the regulatory framework for digital assets between the SEC and CFTC. While lawmakers remain cautiously optimistic, political gridlock and the upcoming 2026 midterm elections are introducing further uncertainty into the legislative process.

Government Shutdown Stalls Progress on Crypto Legislation

As the federal government enters its second week of shutdown, thousands of federal employees are furloughed, slowing critical work on drafting the crypto regulation bill. Kristin Smith of the Solana Policy Institute called the halt “the biggest setback for U.S. crypto legislation at the moment.” With agency staff unable to participate fully, key advisors are absent from discussions that would shape the bill.

Ron Hammond, a crypto strategist at Wintermute, estimates there’s only a 60% chance the bill will be voted on before the end of the year, warning that an extended shutdown could significantly reduce those odds.

Political Calculations Ahead of 2026 Midterms

The legislative future of crypto is increasingly influenced by political strategy. With midterm elections approaching in 2026, lawmakers may prioritize campaigning over complex bills. Some Democrats are highlighting former President Donald Trump’s involvement in crypto ventures, including World Liberty Financial and TRUMP memecoins, as part of election narratives.

Rebecca Liao, CEO of Saga, stressed, “Crypto policy remains too important to be sidelined completely, even amid political tensions. However, prolonged shutdowns may slow progress, giving lawmakers reasons to distance themselves from crypto-friendly stances.”

Complexity in Passing a Comprehensive Crypto Market Structure Bill

Passing a robust crypto market structure bill is proving more challenging than the GENIUS Act the stablecoin legislation passed earlier this year. Key debates include defining ancillary assets (such as cryptocurrencies not classified as securities) and applying money transmission laws to decentralized networks.

Former SEC counsel Teresa Goody Guillén highlighted the need for simplification, stating, “The current draft relies heavily on decentralization terminology that could confuse both regulators and innovators. Simplifying language is essential for effective implementation.”

Summer Mersinger of the Blockchain Association noted, “Both parties agree on the necessity of clear, balanced crypto regulations. While the shutdown has slowed momentum, bipartisan cooperation could still deliver a framework that fosters innovation while providing clarity for the crypto industry.”

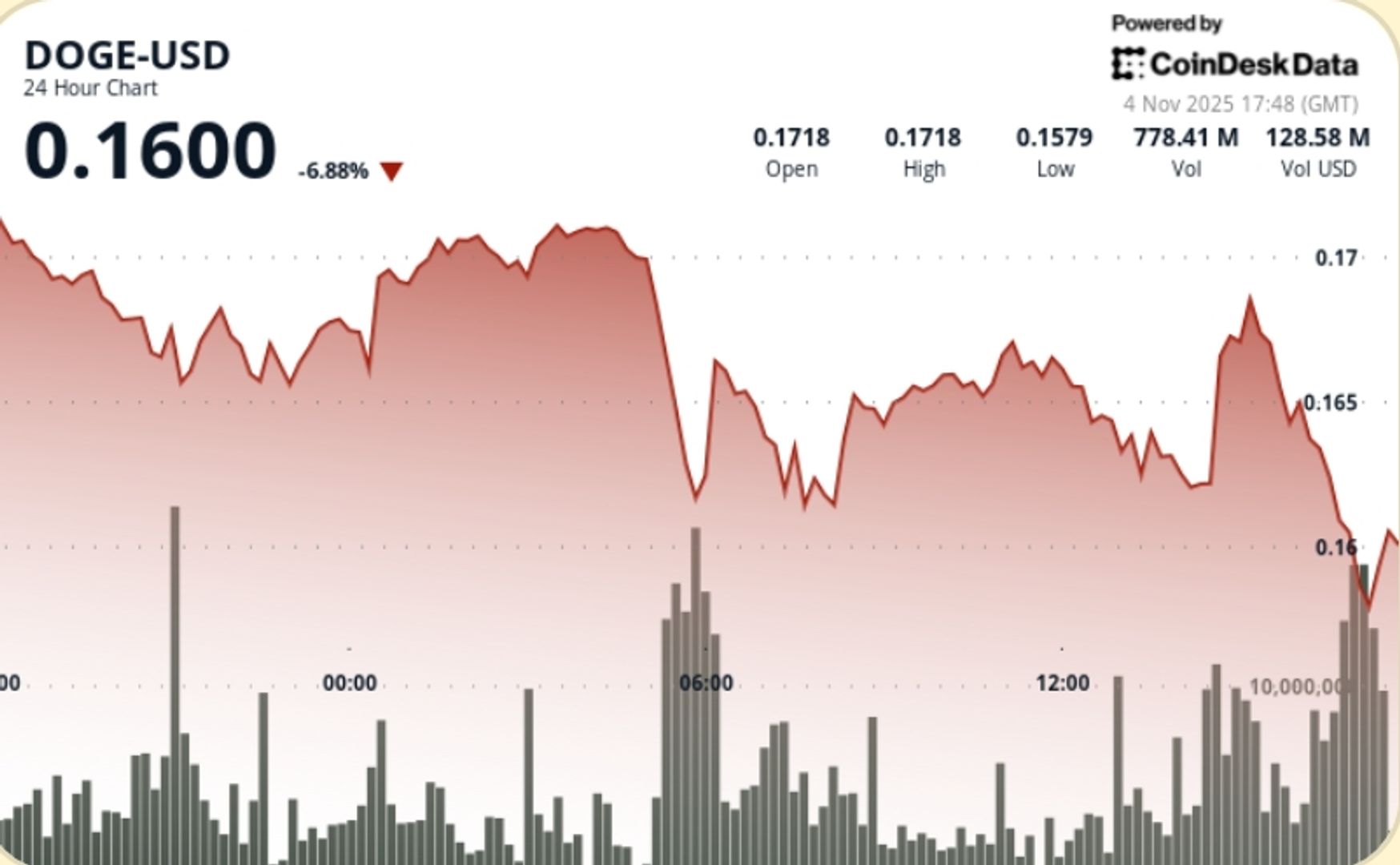

Crypto Market Reacts to Legislative Uncertainty

Following the political gridlock, the crypto market faced a sharp downturn. Bitcoin fell below $121,000, and total market capitalization dropped to $4.15 trillion. Over 180,000 bullish traders were liquidated, triggering forced selling across Ethereum, Solana, and other major cryptocurrencies. Analysts attribute part of the sell-off to investors taking profits after Bitcoin’s recent rally to $126,000, while fears of a potential AI market bubble added pressure on digital assets.

Market strategist Ron Hammond added, “Uncertainty in U.S. crypto regulation directly impacts market sentiment. Traders are cautious as they wait for clarity from Washington.”

1 month ago

5900

1 month ago

5900

English (US)

English (US)