A wave of aggressive buying has hit Chainlink (LINK), as on-chain data indicates whales are quietly scooping up millions of tokens despite recent market turbulence.

According to blockchain analytics firm Lookonchain, 30 newly created wallets have withdrawn 6.25 million LINK, worth approximately $116.7 million, from Binance since the market crash on October 11.

According to the October 20 data, The largest single wallet withdrew 1.34 million LINK, valued at over $25 million, while several others accumulated between $3 million and $6 million each.

Together, the 30 wallets now hold more than $116 million in LINK, marking one of the largest whale accumulation events for the asset this year.

Data suggests these whales, likely institutional, began accumulating LINK in large batches shortly after the market downturn, signaling a strategic move rather than routine trading.

Such withdrawals are often bullish, as moving tokens off exchanges typically indicates long-term holding.

This trend has fueled speculation that whales are positioning for a potential Chainlink rally, especially as the protocol’s oracle services see growing adoption across major blockchain ecosystems.

LINK price analysis

Notably, this whale accumulation has impacted LINK’s price. As of press time, the asset was trading at $19.01, up over 10% in the past 24 hours, though it remains down about 1% on the weekly timeframe.

LINK has taken a hit from the recent market dip, with the current price below its 50-day simple moving average (SMA) of $21.56 but above the 200-day SMA of $17.69.

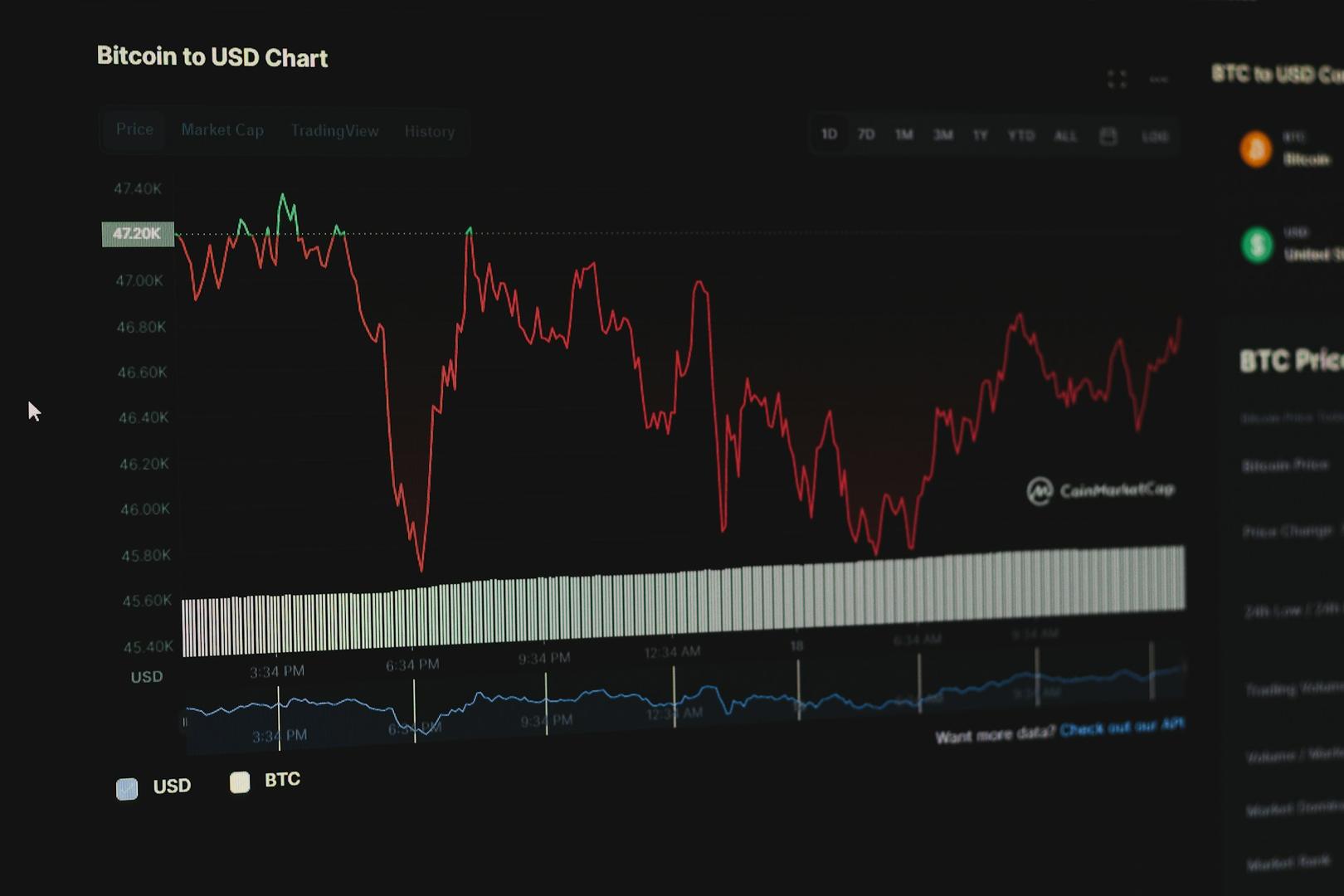

LINK seven-day price chart. Source: Finbold

LINK seven-day price chart. Source: FinboldThis setup suggests short-term weakness within a broader long-term uptrend. The gap below the 50-day SMA indicates selling pressure or a potential consolidation phase before any bullish continuation.

Meanwhile, the 14-day Relative Strength Index (RSI) stands at 36.76, placing LINK in neutral territory but leaning toward oversold conditions.

Featured image via Shutterstock

The post This altcoin is recording insane whale accumulation appeared first on Finbold.

3 months ago

27228

3 months ago

27228

English (US)

English (US)