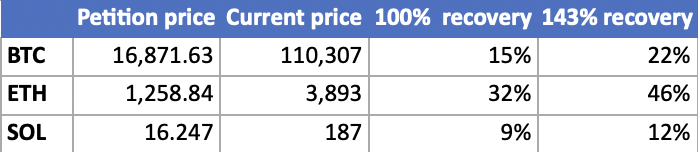

FTX creditors will recover only 9–46% of their holdings in real cryptocurrency terms, according to a statement from Sunil Kavuri. The head of FTX’s largest creditor group posted on X, noting that FTX creditors remain unreconciled. He noted that even with a nominal payout of 143% of claims, the true value is lower due to higher crypto prices since the filing.

Based on the table Sunil shared in the post, the BTC petition price was $16,871, compared to the current price of over $110,000. This means that a 143% fiat payout is equivalent to roughly 22% in real BTC value. In the same vein, 143% of Ether would actually equal 46%. Solana, on the other hand, would be paid out at a rate of 12%.

Some payments imply a higher dollar sum than the initial claim’s nominal price. However, in actual crypto terms, creditors come out well below the projected recovery.

Fraudsters target FTX creditors with scams and fake airdrops

Sunil also warned creditors about scams and impersonators targeting them. He claimed that some actors impersonated recovery projects, while others claimed to have FTX partnerships and organized fake airdrops.

He noted that these activities were done to recover from FTX creditors, which is why they were a high-value, largely targeted group. Sunil recommended that all creditors must verify everything. While there are a few legitimate crypto projects conducting airdrops to compensate FTX victims, Sunil advised against following any distributed links or visiting websites that were not verified by reliable sources.

The initial round of FTX creditor payments for recipients with claims of under $50,000 was distributed on February 18, totaling $1.2 billion. It was followed by the FTX Recovery Trust establishing its second $5 billion payout to eligible creditors. The payment covered multiple claim categories, including Dotcom Customer Entitlement Claims (72%), US Customer Entitlement Claims (54%), and Convenience Claims (120%).

In the meantime, General Unsecured and Digital Asset Loan Claims are expected to get 61% distributions, with funds anticipated to be distributed to recipients via Kraken and BitGo within one to two business days.

The bankruptcy plan came to an end in October 2024, leveraging over $15 billion in recovered assets, including cash reserves from FTX’s operations, recovered funds from clawbacks, and proceeds from selling investments like Bankman-Fried’s stake in AI studio Anthropic and brokerage Robinhood, as well as massive stockpiles of tokens like SOL and SUI.

It may seem that the affected clients are still not receiving as much as they had hoped, but many of them did not expect to see any of their FTX funds anyway, so for them, the distribution is a more welcome financial reprieve

Founder’s pardon stirs debate amid crypto politics

Sam Bankman-Fried (SBF), the controversial founder of FTX, is presently serving a 25-year prison sentence for fraud and conspiracy. Nevertheless, his name is being actively referenced in the political and crypto spheres.

In October 2025, SBF’s odds of being pardoned by US President Donald Trump rose amongst Polymarket bettors following news that he had granted clemency to Binance founder Changpeng ‘CZ’ Zhao, a poll on the decentralized prediction market shows.

Individuals in contact with SBF’s lawyers are confident that he is attempting to persuade the court that the case was not legally sound, specifically arguing that FTX was not legally insolvent.

SBF emphasizes that FTX was never insolvent, arguing that the exchange’s assets always outweighed its liabilities and that every customer could’ve been made whole by late November 2022.

At the beginning of October, the disgraced FTX founder took to social media to allege that “Biden’s anti-crypto SEC/DOJ went after me” and had arrested him in 2022 as a means of preventing his testimony on Capitol Hill the next day.

“They had me arrested weeks before the crypto bill I was working on was set for a vote—and the night before I was set to testify before Congress,” a post on Bankman-Fried’s official Gettr account says.

For now, SBF Bankman-Fried is expected to appear before the US Court of Appeals for the Second Circuit on Nov. 4.

Join Bybit now and claim a $50 bonus in minutes

English (US)

English (US)