XRP’s recent pullback to $2 has not changed the broader technical picture, according to a new analysis shared on X by crypto analyst Egrag Crypto. Despite the lack of bullish price action in recent weeks, the technical analysis proposes that the market structure continues to favor an upside continuation rather than the trend ending.

This outlook places the next three to six months in a constructive zone for XRP’s price action, where the probability of further upside is higher than the risk of a downward move.

XRP Currently In Consolidation, Not Distribution

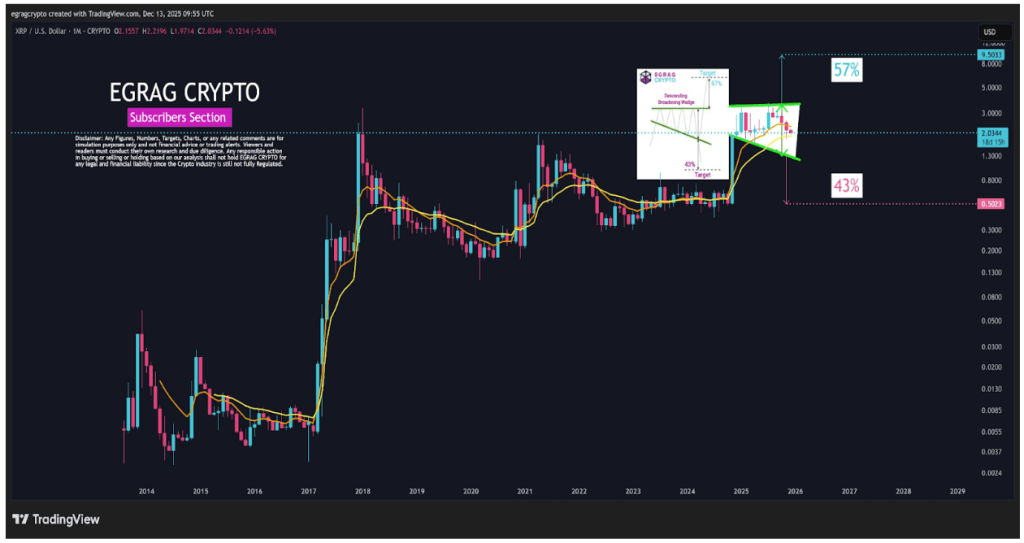

The assessment of Egrag’s technical analysis is based on XRP’s price action currently ticking a list of boxes that points to the next move being up. The first of these boxes is what the analyst referred to as a regime shift, which occurred after the XRP price made a decisive breakout from a multi-year base around $0.5 last year.

This decisive breakout shifted the market from accumulation to expansion. Pullbacks in this phase are usually corrective, not trend-ending. In that context, the current price action can be viewed as part of a natural pause rather than a signal that the larger bullish move has failed.

Another central argument in the analysis is that the current price behavior represents consolidation rather than distribution. Egrag Crypto describes the market as being in a compression phase following an impulse, and this is a pause, not a top. Although XRP has spent about 13 months ranging within this structure, the analyst interpreted this as extended consolidation instead of a distribution process.

Chart Image From X. Source: @egragcrypto On X

EMA Structure Keeps Bullish Bias Intact

Another reason as to why the trend is more likely bullish is because XRP is still trading in alignment with its long-term exponential moving average, which remains above the 21 EMA. That relationship preserves the bullish bias, even though price currently sits below the faster 9 EMA, but this only reflects short-term weakness rather than a structural breakdown.

Beyond pure chart structure, fundamental developments have added weight to the case for longer-term appreciation. XRP is currently holding $2 as an important support zone, and recent developments have emerged that could increase bullish sentiment.

An example is Ripple’s conditional approval alongside other crypto firms for a national trust bank charter from the US Office of the Comptroller of the Currency.

Although the outlook is much more bullish, there is always the possibility of turning bearish within the next six months. According to Egrag, this outlook can only turn bearish if XRP records a sustained monthly close below the $1.80 to $1.60 region.

Taken together, the analysis concludes that XRP is more likely to resolve higher than lower over the next three to six months, even if there is price volatility along the way.

Featured image from Unsplash, chart from TradingView

1 month ago

8644

1 month ago

8644

English (US)

English (US)