The post Monero Price Rebounds at Channel Support: Is XMR Headed Back Toward $500? appeared first on Coinpedia Fintech News

Monero (XMR) is showing early signs of stabilization after a prolonged decline, rising over 3% on the day as price reacts from a technically significant support zone. The bounce comes at a critical moment, with XMR retesting the lower edge of a multi-week rising channel while broader crypto markets remain fragile. This creates a familiar dilemma: Is the move simply a relief bounce inside a weakening trend, or the early phase of a rotation back toward the upper channel near $500?

Monero Price Defends Channel Support: Reversal Imminent?

Monero’s price has defended the channel support zone of $380 and showed a pullback during the intraday session. This bounce has remained orderly rather than impulsive. As XMR approached the lower edge of the channel, selling pressure slowed gradually, with downside wicks expanded, suggesting sellers are no longer in control at current levels. Technically, the $360-$380 region has emerged as a demand zone.

As long as Monero price holds above this zone, the broader channel structure remains intact. The immediate test now lies at $390-$400, where sellers placed their positions. A strong break of this region would shift the corrective structure to neutral-bullish, opening the door toward $420-$450. While further strength above the 50-day EMA mark could extend the recovery toward the $480-$500 zone back into focus as a rotational target rather than a distant hope. On the other side, a break below $360, however, would invalidate the channel and expose deeper downside making the current bounce technically decisive.

Open Interest and Liquidation Map Point to Short-Covering Risk

Derivatives data adds weight to the rebound scenario. Monero’s future open interest has risen above $142 million, up more than 4% even as price stabilizes, a sign that traders are adding exposure, not exiting. This increase in open interest alongside price rise often signals shorts being forced to defend positions, especially when price sits near crucial support.

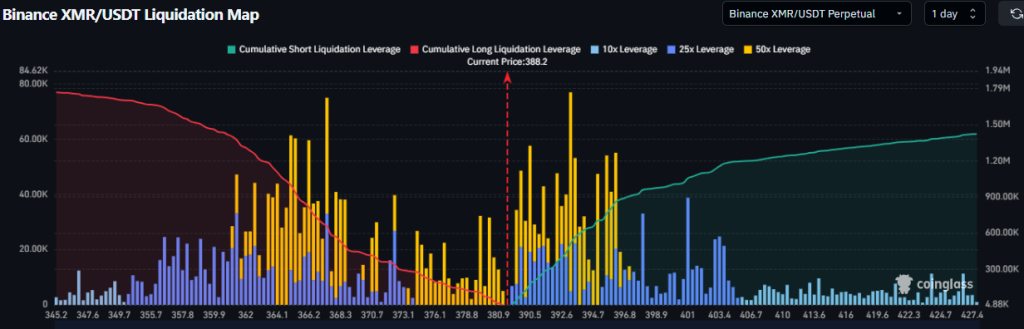

Liquidation heatmap data shows a clean cluster of short liquidation levels stacked above the current range, particularly between $390 and $410. If XMR price pushes into this zone, forced short closures could accelerate upside momentum, turning a slow rebound into a sharp squeeze. At the same time, downside liquidation pressure appears relatively thin below current price levels, reinforcing the idea that sell-side leverage has already been flushed during the prior decline.

Broader Context Keeps Reversal in Check

Despite the improving micro-structure, Monero is still trading within a broader environment of risk aversion, where capital remains selective and volatility elevated. Privacy-focused assets have lagged during recent market weakness, making confirmation, not anticipation. This means the rebound needs a follow-through, not just reaction. Without acceptance above reclaimed resistance, the move risks fading into another lower-high sequence. As XMR price remains at a decision point, holding above the support zone of $360 keeps the path toward $400-$420 viable.

2 hours ago

280

2 hours ago

280

English (US)

English (US)