Key takeaways:

- Monero price prediction suggests a bullish trend, with XMR anticipated to reach $705.98 by the end of 2025.

- XMR could reach a maximum price of $1,466.81 by the end of 2028.

- By 2031, Monero’s price may surge to $3,363.29.

Monero (XMR) stands out in the crypto space for its strong focus on privacy and decentralization of transactions., making it one of the leading privacy focused cryptocurrencies. This makes it a popular choice for privacy advocates and those prioritizing security. The Monero ecosystem constantly evolves, marked by significant milestones like enhanced protocol upgrades and growing adoption across various sectors, which underscore its utility.

As Monero progresses, many wonder about its future price trajectory. Will its unique features drive significant value growth, as many traders speculate? Can it sustain its competitive edge in the ever-evolving crypto market? Will XMR recapture its ATH at $517.62 in the long term forecast?

Overview

| Cryptocurrency | Monero |

| Token | XMR |

| Price | $320.21 (3.66%) |

| Market Cap | $5.9 Billion |

| Trading Volume (24-hour) | $254 Million |

| Circulating Supply | 18,446,744.07 XMR |

| All-time High | $517.62 May 07, 2021 |

| All-time Low | $0.213, Jan 15, 2015 |

| 24-h High | $330.46 |

| 24-h Low | $306.93 |

Monero price prediction: Technical analysis

| Sentiment | Bullish |

| 50-Day SMA | $291.19 |

| 200-Day SMA | $292.86 |

| Price Prediction | $676.67 (111.28%) |

| F & G Index | 34.86 (fear) |

| Green Days | 13/30 (44%) |

| 14-Day RSI | 55.72 |

Monero price analysis

TL;DR Breakdown

- Monero price shows fall towards $280 before recovery

- The XMR coin rose by over 3.66% at the time of writing.

- Monero price has support and resistance at $300 and $340, respectively.

The Monero price history and analysis for October 15 shows recovery for XMR as it climbs back from the lows of $280 back above the $320 mark.

Monero price analysis 1-day chart: XMR returns to $320

The 24-hour XMR/USD price chart indicates a strongly bearish market sentiment as the asset loses over 5% of its value across the last seven days. After oscillating between the $320 and $340 level the price crashed to the $266.35 level before climbing back above the $320 level.

XMR/USDT price chart: TradingView

XMR/USDT price chart: TradingViewThe indicators reflect the rising bullish price sentiment, as all three major technical indicators show falling selling pressure. The MACD shows falling bearish pressure at current price level. Moreover, the RSI has risen back to the neutral region showing bearish market dominance as the index returns to 55.73. The diverging Bollinger Bands suggest high volatility across the next few days.

Monero price analysis 4-hour chart

The 4-hour price chart shows that Monero observed strong bullish momentum until it reached the $340 level where it finds short-term resistance level and returned back to the $320 level. The recent drop to the $265 level was followed by swift recovery back to the $330 level but the bulls were rejected at the level falling back to $320.

XMR/USDT price chart: TradingView

XMR/USDT price chart: TradingViewThe RSI is at 55.57, showing neutral trend position as XMR returns to the centerline of the Bollinger Bands. The MACD, at 1.96 shows falling bullish pressure on the 4-hour charts as price falls back to $320. Additionally, the EMAs are trading around the mean value, which suggests a mixed market sentiment. These indicators collectively issue mixed market sentiments suggesting further decline towards $312.

Monero technical indicators: Levels and actions

Daily simple moving average (SMA)

| EMA 3 | $ 305.25 | BUY |

| EMA 5 | $ 296.82 | BUY |

| EMA 10 | $ 285.55 | BUY |

| EMA 21 | $ 278.82 | BUY |

| EMA 50 | $ 285.25 | BUY |

| EMA 100 | $ 290.34 | BUY |

| EMA 200 | $ 275.98 | BUY |

Daily exponential moving average (EMA)

| SMA 3 | $ 292.32 | BUY |

| SMA 5 | $ 298.75 | BUY |

| SMA 10 | $ 313.13 | BUY |

| SMA 21 | $ 307.40 | BUY |

| SMA 50 | $ 295.11 | BUY |

| SMA 100 | $ 297.75 | BUY |

| SMA 200 | $ 282.99 | BUY |

What to expect from Monero price analysis?

XMR/USDT price chart: TradingView

XMR/USDT price chart: TradingViewMonero price analysis shows that XMR experienced strong as the price rapidly rose to the $340 mark. However, the price faced strong bearish pressure at the level causing a decline to the $265 level. With the recent recovery to $320 XMR is expected to consolidate at the level.

According to our analysis, we expect the XMR price to consolidate at the current level as the trend corrects. The price should be expected to trade below the $335 mark but is not expected to fall below $300. On the other hand, a bearish breakout would mean a drop below the $285 level back to the $265 mark.

Is Monero a good investment?

Monero is an attractive investment because it emphasizes privacy and security, utilizing advanced cryptographic techniques to ensure transaction confidentiality, which has created a strong demand in the market . Its growing adoption across various use cases and a decentralized development model enhance its long-term potential.

With a limited supply and increasing investor interest, Monero offers a unique opportunity for those seeking financial autonomy and privacy to invest in cryptocurrency. However, investors should remain cautious of regulatory risks and market volatility when considering Monero as part of their portfolio, making it essential to seek investment advice.

Why is XMR up?

Monero price analysis shows that XMR saw a swift recovery from $266 lows to the $330 price level before falling back to $320 where it trades at press time.

Will XMR recover to its all-time high?

Monero is expected to recover toward its all-time high of $518 by mid-2026 as the privacy chain continues to reduce its tech debt and progresses toward greater utility and privacy. However, the platform might have to overcome regulatory scrutiny and challenges before it can see mass adoption, as it remains highly speculative .

How much will Monero be worth in 5 years?

The Monero price prediction for 2030 suggests a minimum price of $1,048.76 and an average trading price of $1,142.11. The maximum forecasted price is set at $1,208.35.

Will XMR reach $1000?

The chances of Monero (XMR) hitting $1,000 hinge on various factors, which will influence its future price movements. The adoption of privacy transactions and technological advances could increase demand. Favorable regulations and market sentiment toward privacy coins would also help. Yet, regulatory risks, competition, and market volatility are challenges that could hinder significant growth. $1,000 is possible with favorable conditions, especially considering the current price but market dynamics and regulations will shape its path.

Does XMR have a good long-term future?

Monero (XMR) has the potential for a strong long-term future due to its focus on privacy and security, which makes it attractive to users seeking anonymity. However, many investors have concerns regarding privacy, regulatory scrutiny, and notoriety from being the favored medium for some past criminals, which impact the current Monero sentiment. Monero’s commitment to privacy gives it a solid foundation for long-term growth, but it must carefully navigate market and regulatory landscapes.

Recent news/ opinion on Monero

Monero recently announced that the first testnet (alpha stressnet) for Full-Chain Membership Proofs (FCMP++) is now live

Monero price prediction October 2025

The XMR price prediction for October 2025 suggests a minimum value of $273.19 and an average price of $320.99. The price could reach a maximum of $372.16 during the month, reflecting the broader category of digital assets.

| Month | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| October | 273.19 | 320.99 | 372.16 |

Monero price prediction 2025

The Monero price prediction for 2025 anticipates a potential increase driven by growing adoption, with a maximum price forecasted at $573.01. Based on current analysis, investors can expect an average trading price of $558.44, while the minimum price could be around $233.64.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 233.64 | 558.44 | 573.01 |

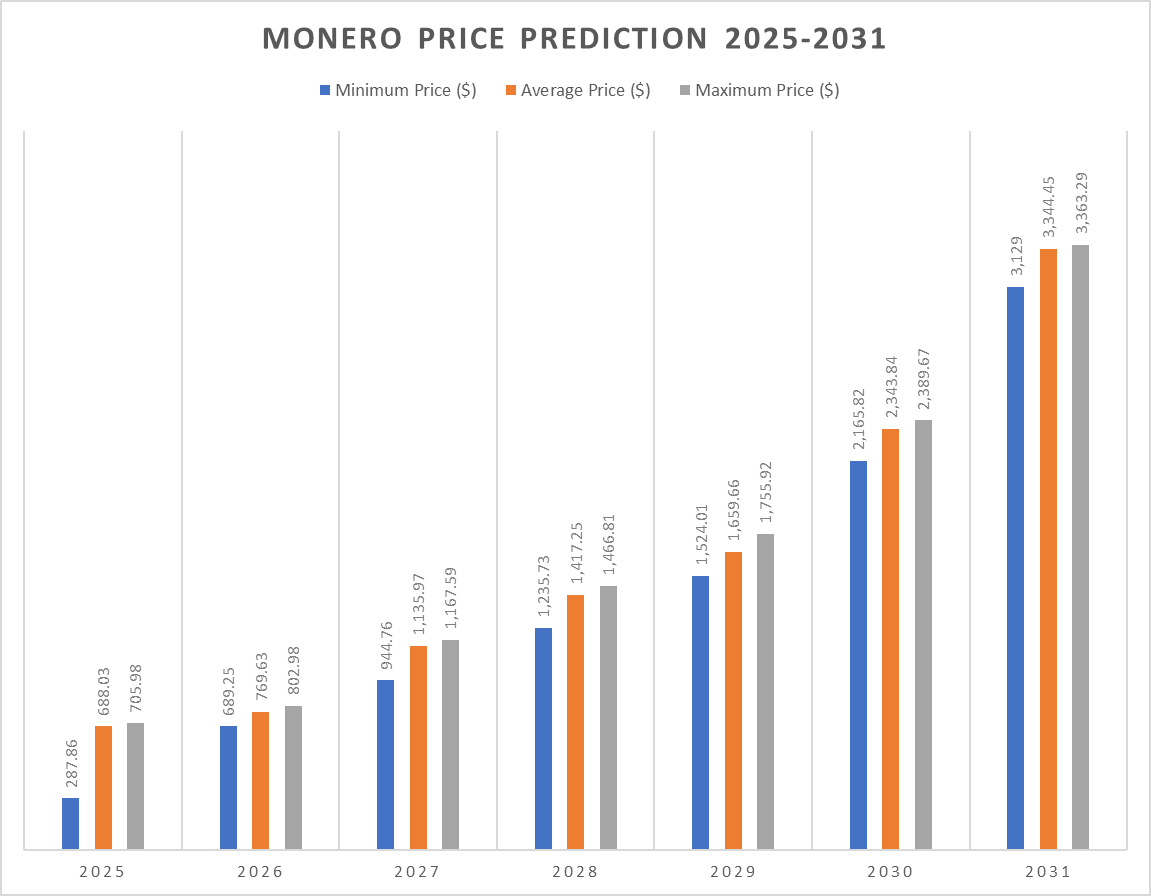

Monero price prediction 2026-2031

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 559.43 | 624.67 | 651.74 |

| 2027 | 766.82 | 922.01 | 947.68 |

| 2028 | 1,002.99 | 1,150.32 | 1,190.54 |

| 2029 | 1,236.97 | 1,347.07 | 1,425.20 |

| 2030 | 1,757.90 | 1,902.39 | 1,939.59 |

| 2031 | 2,539.67 | 2,714.53 | 2,729.83 |

Monero Price Prediction 2026

According to the updated XMR price forecast for 2026, Monero is projected to have a minimum trading price of $689.25. The expected maximum price could reach $802.98, with an average price hovering around $769.63.

Monero Price Prediction 2027

In 2027, Monero’s value is forecasted to continue its upward trend, with the minimum price expected at $944.76, the maximum price at $1,167.59, and an average price of approximately $1,135.97.

Monero Price Prediction 2028

For 2028, Monero is anticipated to trade at a minimum of $1,235.73, while the average price is expected to be $1,417.25, and the maximum price could climb to $1,466.81.

Monero Price Prediction 2029

The price outlook for 2029 suggests Monero will maintain a minimum of $1,524.01, an average of $1,659.66, and a maximum of $1,755.92.

Monero Price Prediction 2030

By 2030, Monero is forecasted to achieve a minimum trading price of $2,165.82, with an average around $2,343.84 and a potential peak of $2,389.67.

Monero Price Prediction 2031

In 2031, Monero’s price is expected to reach a minimum of $3,129.00, while averaging $3,344.45. The maximum projected value is $3,363.29.

XMR Price Prediction

XMR Price PredictionMonero market price prediction: Analysts’ XMR price forecast

| Firm | 2025 | 2026 |

| CoinCodex | $391.87 | $427.02 |

| Digitalcoinprice | $349.23 | $563.02 |

Cryptopolitan’s Monero (XMR) price prediction

Cryptopolitan’s Monero price forecast suggests a bullish outlook for XMR’s future should the market recover. According to expert analysis, Monero could reach a maximum price of $705.98, positioning it among the top crypto coins record a minimum price of $287.86, and trade at an average price of $688.03 by the end of 2025.

Monero historic price sentiment

XMR price history

XMR price history- Monero’s market value has changed dramatically since its launch in 2014, from less than $1 to over $475.

- May 2021 marked the highest point in Monero’s history. Monero’s price projections revealed the coin’s security. They provide investors with optimism that they will be freed from the persecution of some authorities simply by buying or selling Monero

- Across 2023, Monero’s price rose by 11.49%. The highest price was $278.56, and the lowest was $114.16.

- In January 2024, Monero stayed stable around the $150.00 mark as market momentum remained low. However, the stability was short-lived as February crashed to $101.95. However, XMR showed swift recovery as it closed the month near the $150.00 level again.

- In March and April 2024, XMR saw a steady decline from $150.00 to $120.00, where it found key support.

- In May 2024, XMR observed steady bullish pressure as the price rose from $120.00, approaching resistance at $150.

- In June 2024, Monero (XMR) traded within the $150 – $175 price range as either side struggled to make a clear breakthrough. In July, the crypto traded around the $155 mark as the price volatility remained relatively low. XMR opened trading at $156.05 in August and ended the month at $176.00, making remarkable gains.

- September was bearish for the asset, as the price declined below the $160 mark by the end of the month. In October, Monero observed a steep crash and has been making a swift recovery since then.

- In December, Monero made remarkable strides as the asset’s price broke past the $220 mark, albeit briefly as it closed the month below $200.

- In January, Monero saw a bullish January as the price rose from below the $200 mark to $238 by the end of the month.

- In February, the price fell towards the $215 mark as bears dominate the markets. In March, the price observes mixed momentum and closed the month slightly below $215. In April the consolidation continued until late into the month when it spiked past the $325 mark before ending the month around $275.

- In May the price continued rising rapidly as the bulls cruised past $300 ending the month around $320. During June the price continued to observe high volatility but observed low net change as the asset closed the month around $313.

- In July the price saw a huge spike in volatility as the price rose past $340 but the asset closed the month below the $310 mark. In August the price declined rapidly falling to the $260 mark by the month’s end. In September, the price rose to the $340 and while it did not maintain the level but managed to close the month above the $320 mark.

English (US)

English (US)