A cryptocurrency trader has narrowly missed out on a potential $4 million payout after placing a bet on a U.S. military strike against Iran.

Indeed, the investor missed out after the attack failed to materialize by the market’s deadline.

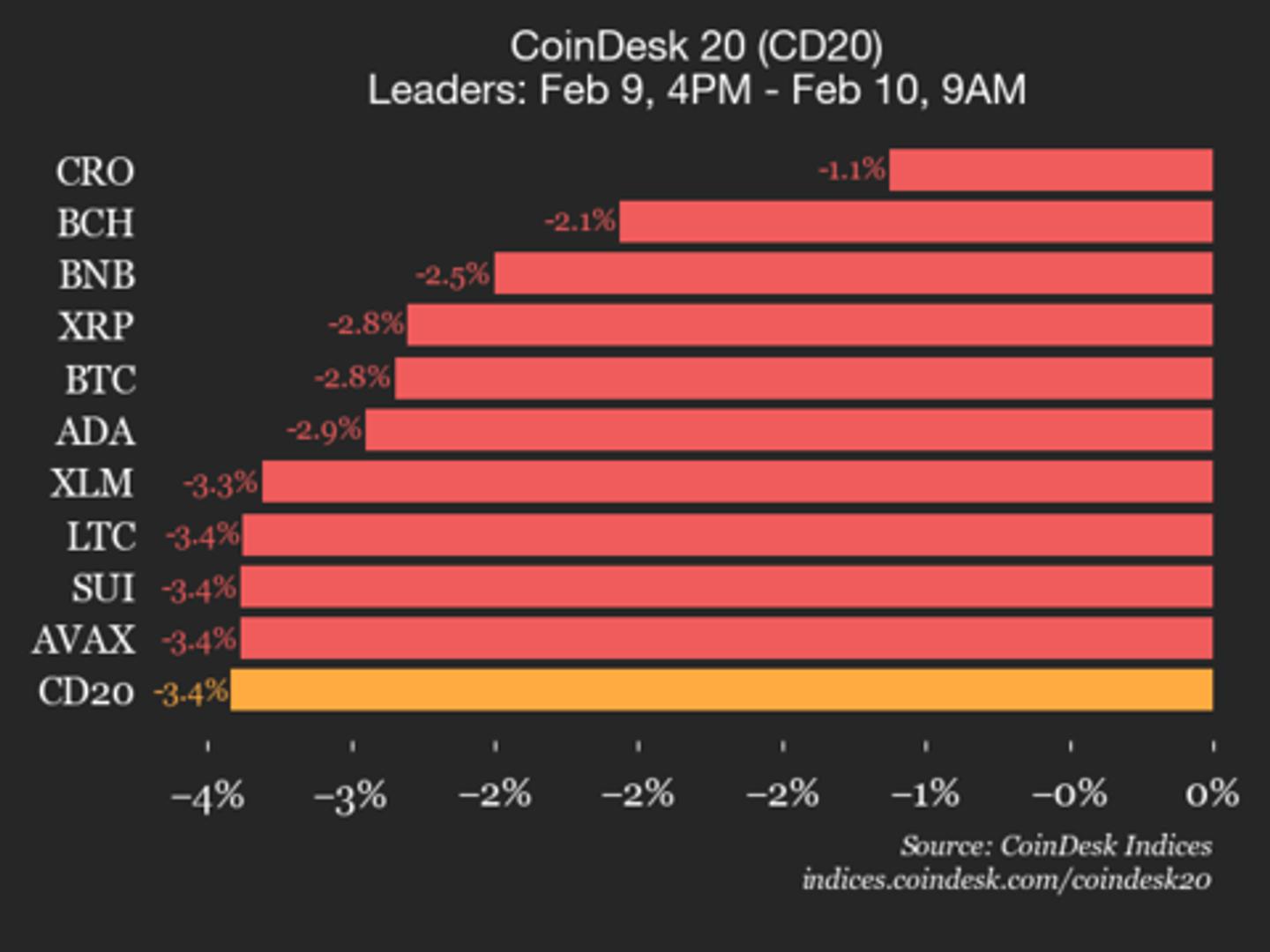

Particulars of the trade indicate that a bet placed on Polymarket shows the trader operating under the username thesecondhighlander committed roughly $100,000 to a contract predicting that the United States would strike Iran by February 9, 2026.

The position, accumulated at an average price of just $0.20 per share, briefly surged in value as geopolitical tensions escalated, lifting the trader’s unrealized gains to more than $115,000. However, once the deadline passed without a confirmed strike, the bet expired worthless.

Crypto trader’s bet on U.S. -Iran attack. Source: Polymarket

Crypto trader’s bet on U.S. -Iran attack. Source: Polymarket Had the event occurred, the payout would have exceeded $4 million, making it one of the largest single geopolitical wins on the platform to date. Instead, the trader’s all-time Polymarket performance shows losses exceeding $66,000.

The failed wager comes amid heightened scrutiny of prediction markets, which have seen surging volumes tied to potential U.S. military action against Iran.

In recent weeks, contracts pricing the likelihood of a strike briefly implied probabilities above 50%, reflecting trader sentiment rather than verified intelligence.

Possible insider information use

Concerns over insider knowledge have intensified following reports of suspiciously timed bets ahead of U.S. actions abroad, including the capture of Venezuelan President Nicolás Maduro earlier this year.

Traders who took large positions shortly before that event reportedly made significant profits, fueling debate over the possible use of non-public information.

In this case, as reported by Finbold, three newly created wallets generated more than $630,000 in profits by betting on Maduro being out of office shortly before his arrest.

The biggest winner turned an investment of about $34,000 into nearly $410,000, while two other wallets converted smaller stakes into combined profits exceeding $220,000.

Suspicion grew due to the narrow and coordinated nature of the trades, with all three wallets focusing exclusively on Venezuela-related markets and rapidly withdrawing funds after the outcomes resolved.

While no wrongdoing has been proven, the episode reignited concerns about potential insider activity and the vulnerability of prediction markets during sensitive geopolitical events.

Featured image via Shutterstock

The post Crypto trader misses out on $4 million fortune in U.S.-Iran attack bet appeared first on Finbold.

2 hours ago

656

2 hours ago

656

English (US)

English (US)