The post Chainlink Price Drops to $17 Breaking Key Support, What’s Next? appeared first on Coinpedia Fintech News

Chainlink’s price action has taken a sharp bearish turn in the past 24 hours sweeping the crypto landscape with uncertainty. The asset crumbled below pivotal $17 support while overall market cap retreated 5.65% and trading volumes soared. The drop comes from from heavy institutional selling amplified by a near doubling in volume to the loss of critical technical levels.

However, some positive developments shine through the gloom such as Virtune’s recent adoption of Chainlink’s Proof of Reserve tech. And ONDO’s integration of LINK as an official oracle for tokenized securities. The road ahead features volatility and pivotal price levels that could decide the asset’s next trajectory.

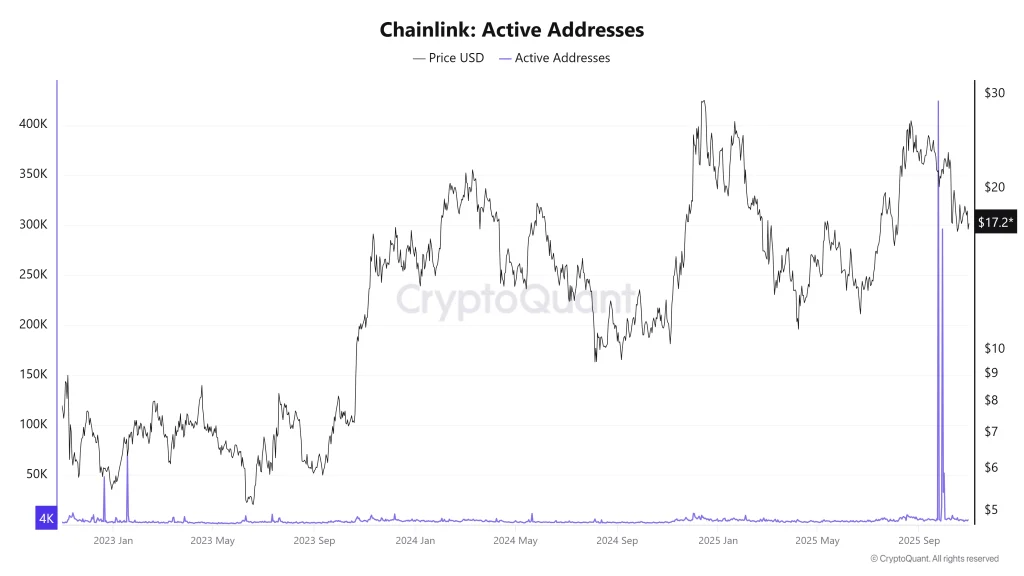

Chainlink Active Addresses

In recent sessions, as per CryptoQuant, active address counts for Chainlink have surged sharply. While the bulk of price movement was negative, the spike in addresses often aligns with increased on-chain activity and signals a potential inflection point for volatility.

It is worth noting that, historically, large jumps in active addresses can precede either strong recoveries or continued downward pressure as trading intensifies. This latest surge is notable given the context of heavy selling with volume nearly doubling. Further suggesting market participants are repositioning for further swings.

LINK Price Analysis

Chainlink’s near-term price outlook is driven by clear technical signals and support and resistance levels. LINK price is currently trading at $17.19, down 5.62% for the day and 2.81% over the last week. It has pierced both a multi-week descending trendline and the crucial 50% Fibonacci zone near $16.92. Successively, the loss of these levels resulted in traders exiting positions as previously bullish patterns were invalidated.

Digging deep into technicals, the RSI at 38.99 cements the bearish momentum, though LINK has yet to hit true oversold territory. Immediate support rests at $16.50. Should selling persist, the next possible floor comes in at $15.33. Contrarily, resistance is now established at $17.20, which aligns as a new pivot point following the breakdown.

FAQs

Chainlink price fell due to heavy institutional selling, loss of key technical support, and overall risk-off sentiment driven by Bitcoin’s correction.

Current support levels are at $16.50 and $15.33, while resistance stands at $17.20.

Spikes in active addresses signal rising on-chain activity and volatility, which could precede either a rebound or deeper decline, depending on how traders react to new momentum.

3 months ago

8977

3 months ago

8977

English (US)

English (US)