Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released its latest Crypto Derivatives Analytics Report, produced in collaboration with Block Scholes, on Tuesday, November 4.

The report gives a comprehensive analysis of crypto derivatives, macroeconomic outlook, and trader sentiment following the $6 billion liquidation on October 10.

Sources: Bybit, Block Scholes

Sources: Bybit, Block ScholesThe liquidation, triggered by renewed U.S.–China trade tensions, prompted widespread deleveraging in perpetual swap markets. Though conditions briefly improved after a subsequent trade deal, any brief optimism was overshadowed by Federal Reserve Chair Jerome Powell’s hawkish remarks during the FOMC press conference.

With trader sentiment uncertain, Bitcoin (BTC) sank to $107,000 and short-term put-call skews turned negative.

Derivatives open interest stagnates as volatility persists

According to the report, notional open interest in perpetual contracts remains below $10 billion, showing little sign of recovery since the selloff. Despite record highs in the U.S. equities market, BTC is struggling to break out of the narrow $105,000–$115,000 range.

Options activity has increased, however, suggesting sustained hedging demand. Rising at-the-money implied volatility and steady interest in short-term puts point to traders maintaining defensive exposure rather than re-leveraging.

WLFI token rebounds but market sentiment mixed

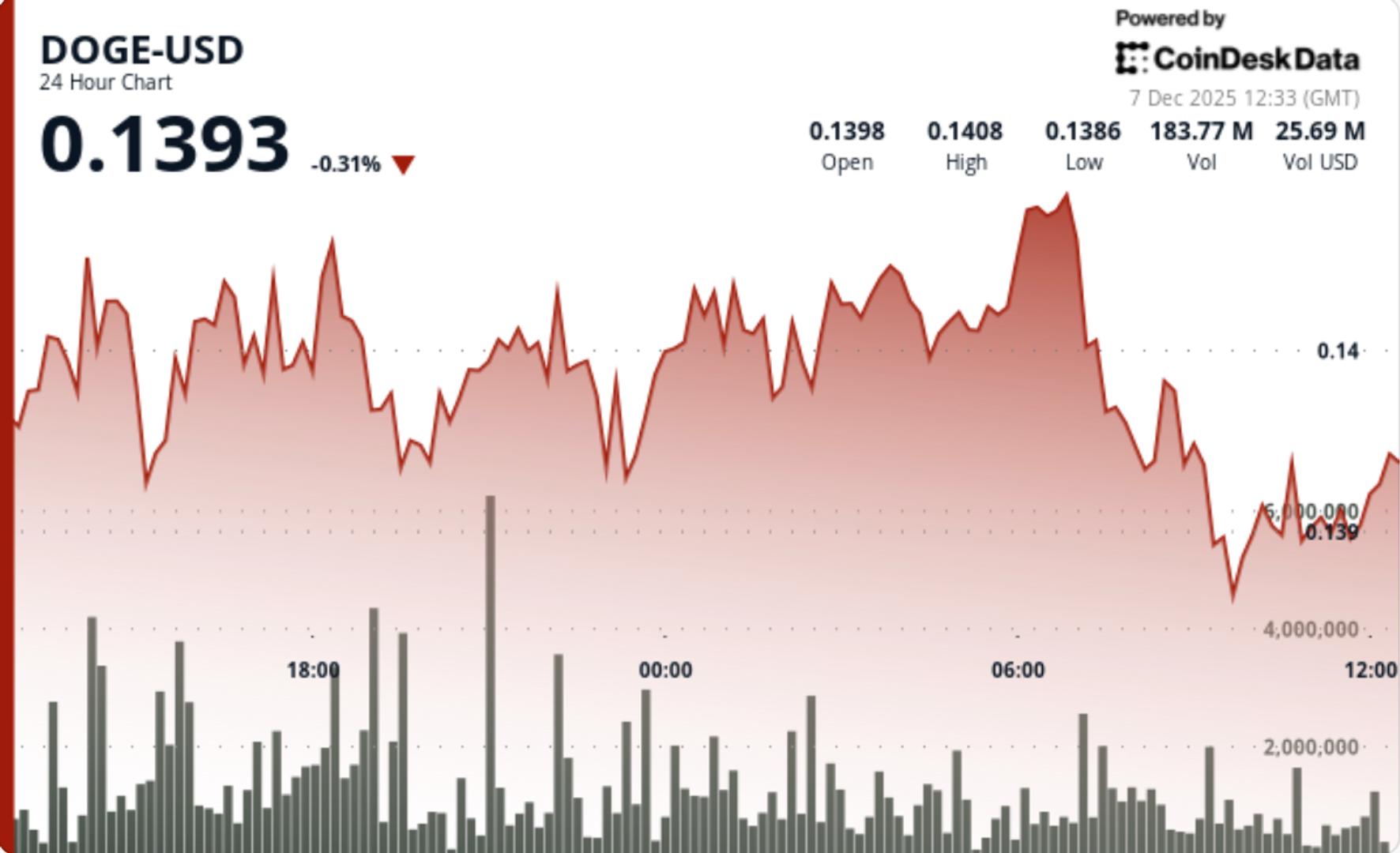

World Liberty Financial (WLF), a decentralized finance (DeFi) platform backed by President Donald Trump and his family, saw its governance token WLFI climb 25% to $0.15 following an 8.4 million WLFI airdrop to early users. However, unstable perpetual funding rates indicate uncertainty remains around the token’s long-term price action.

Sources: Bybit, Block Scholes

Sources: Bybit, Block ScholesUltimately, the report suggests the derivatives market is slowly finding its footing after a period of heavy deleveraging.

Still traders remain cautious, holding off on aggressive positioning as they wait for clearer signals on monetary policy and geopolitical developments.

Featured image via Shutterstock.

The post Bybit and Block Scholes report cautious recovery in crypto derivatives after major October liquidation appeared first on Finbold.

1 month ago

5126

1 month ago

5126

English (US)

English (US)