The post BNB Price at a Crossroads: What Happens Next as Market Pressure Builds? appeared first on Coinpedia Fintech News

As the broader crypto markets struggle to find momentum, BNB Coin (BNB) is quietly holding its ground. With volatility has cooled across major assets, BNB continues to trade within a tight range, refusing to give back recent gains. Instead of reacting to short-term noise, price action suggests the market is reassessing value, not existing positions.

The hesitation has placed the BNB coin at a clear crossroads. The question now is not whether pressure exists, it does but whether buyers have done enough to keep control as the market searches for direction.

BNB Price Searches for a Direction as Volatility Tightens

BNB price chart shows price compressing within a rising structure after a bounce from the demand zone of $830-$850. The series of higher highs and higher lows continue to form above the $880 support zone, while overhead resistance places around $930-$950 caps upside attempts.

Moreover, trading volume has gradually tapered during the recent consolidation around $900. Importantly, BNB price remains above its short-term and medium-term moving averages, which favors the bullish narrative. Once the broader market direction clears, BNB may outperform the market and reach $1000 followed by $1160 in the near sessions. For now, price structure suggests balance between bulls and bears, not weakness.

What the On-Chain Data Suggests ?

BNB’s on-chain data continue to provide structural support. The network recently executed its 34th quarterly token burn, removing roughly 1.37 million BNB from circulation. This ongoing deflationary pressure tightens available supply during periods of sustained demand.

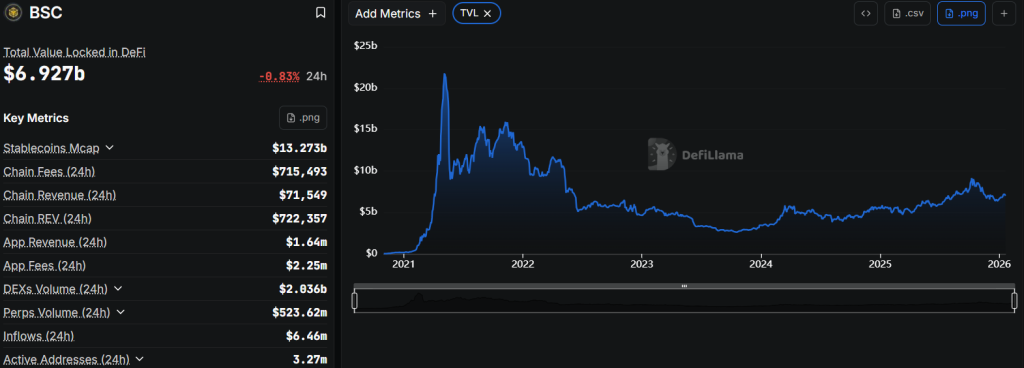

At the same time, BNB Chain activity has remained resilient. Total Value Locked (TVL) across the ecosystem has climbed above $7 billion, while transaction throughput and DeFi participation show steady engagement rather than decline. These metrics suggest that users are still deploying capital on the network, even as the price pauses.

While these developments may not trigger immediate price spikes, they reinforce the idea that BNB’s current range is more likely structural consolidation than distribution.

What Comes Next for BNB

Currently, BNB price sits at a decision point. If buyers maintain control above the support zone of $900, further higher high swing formation could follow ahead. Conversely, a failure to hold the demand zone would signal that consolidation has turned into distribution, opening the door to a deeper retracement.

BNB’s current price behaviour reflects a market that is pausing with intent, not retreating in fear. The chart structure remains intact, downside is protected, and compression suggests a larger move is being prepared. However, direction will matter, but the setup is already telling the rally toward $1000 soon.

1 hour ago

597

1 hour ago

597

English (US)

English (US)