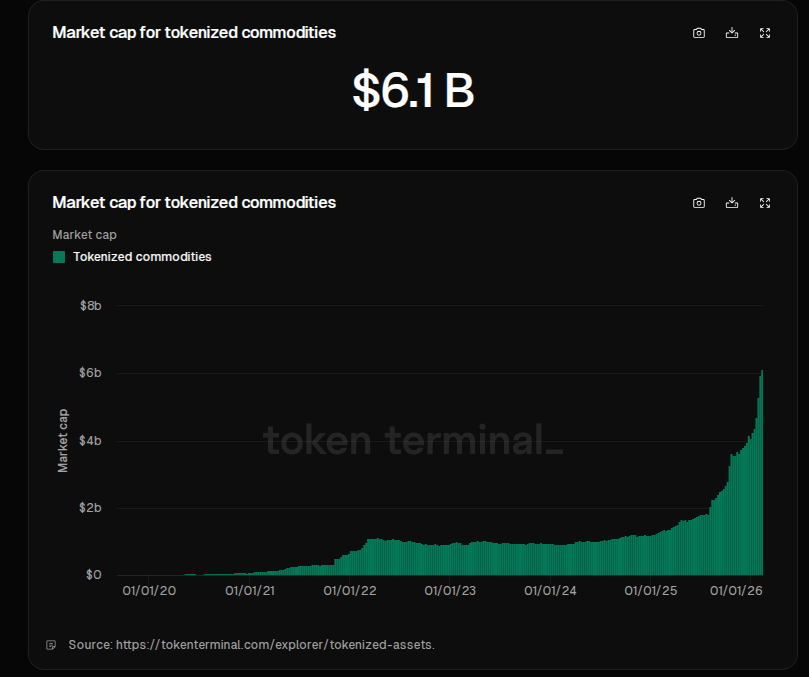

Markets have put more gold on blockchains, And the shift has been rapid. Reports say the tokenized commodities sector grew about 53% in under six weeks, pushing its size to just over $6 billion. That jump has been led by a small group of gold tokens, and the move has traders and some big banks watching closely.

Gold Tokens Drive The Rally

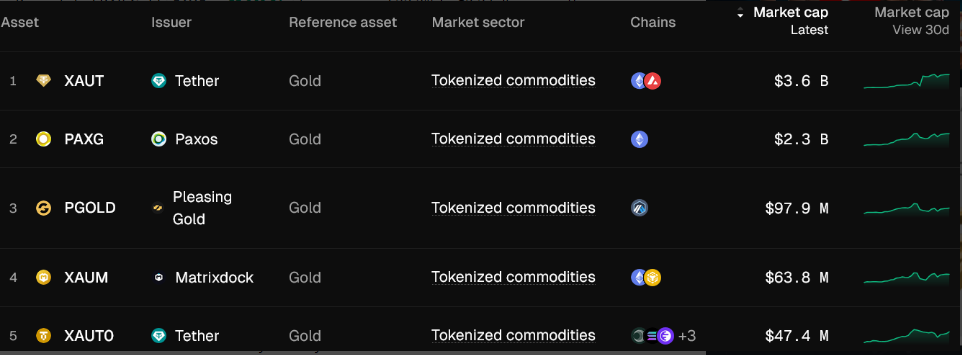

According to on-chain data, most of the fresh value is sitting in Tether’s XAU₮ and Paxos’s PAXG. Together they hold close to $6 billion of the sector’s market worth.

Investors are treating these tokens as a quick way to own a claim on bullion without needing to move bars or deal with vault paperwork. Some buyers want a safe haven that moves easily across borders. Others want to trade fractions of an ounce in online markets.

Tether Moves Toward Physical Integration

Reports say Tether has not stopped at issuing a token. The firm took a $150 million stake in Gold.com with plans to fold XAU₮ into that platform and to let customers pay for actual gold with stablecoins.

This is a step toward tying token balances more directly to physical holdings and sales channels. If it works, retail buyers could use familiar crypto tools to buy and collect real metal, which would change how ordinary people access bullion.

Analysts See Big Upside

Analysts See Big Upside

Based on reports, Geoffrey Kendrick of Standard Chartered has sketched a huge growth path: from roughly $35 billion in tokenized real-world assets today to as much as $2 trillion by 2028.

Alvin Foo, a crypto analyst, has argued that tokenized commodities — gold on public chains in particular — could scale to trillion-dollar values someday, as markets adopt fractional ownership and new trading rails.

Those projections require many pieces to fall into place: clear rules, reliable custody proofs, and wide demand from non-crypto investors. Ambitious goals are being set, but they rest on a chain of technical and legal fixes that are still in progress.

Stablecoin liquidity and decentralized finance plumbing are being pointed to as the plumbing that can support larger markets. Reports note that having quick settlement, low minimums, and easy custody opens bullion to smaller investors and traders who were locked out before.

Fractional ownership is already possible, which means someone can own a slice of a bar without ever visiting a vault. Yet trust must be earned. Custodial audits, insured storage, and transparent minting and redemption rules will shape whether token holders feel secure.

Featured image from Private Banker International, chart from TradingView

2 hours ago

804

2 hours ago

804

English (US)

English (US)