On-chain data shows the Bitcoin short-term holder whales are sitting on their highest unrealized gain of the cycle after the latest rally.

Bitcoin Short-Term Holder Whales Are Carrying $10.1 Billion In Profits

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Bitcoin short-term holder whales have seen their profits hit the highest point of the cycle. The short-term holders (STHs) broadly refer to the BTC investors who purchased the cryptocurrency within the past 155 days. These holders are considered to include the “weak hands” of the market, who tend to panic at the sight of volatility.

In the context of the current topic, the STHs as a whole aren’t of relevance, but rather a specific portion of the cohort: the whales. “Whales” are defined as entities carrying more than 1,000 tokens of the asset in their wallet balance. The STH whales, therefore, would be the holders of this size who got into the market in the last five months.

Bitcoin is currently trading at price levels it has never reached before in its history, so the STHs (barring those who bought at the weekend high above $125,000) would naturally all be in profit at the moment. An indicator that can highlight the scale of their gain is the Unrealized P&L, which measures, as its name suggests, the net amount of unrealized profit/loss that Bitcoin holders are carrying right now.

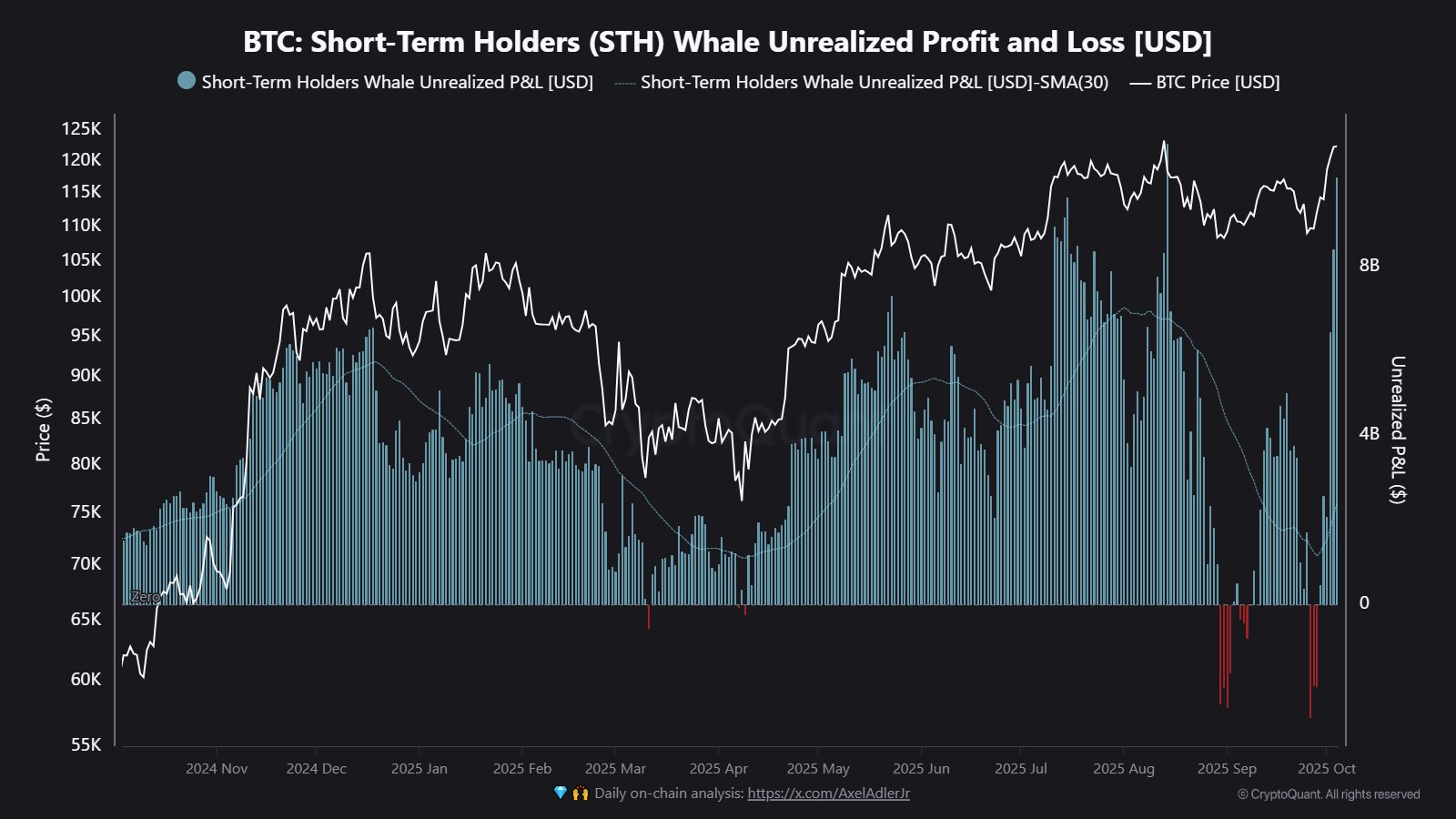

Below is the chart shared by Maartunn that shows the trend in this indicator for the Bitcoin STH whales over the past year.

From the graph, it’s visible that the Bitcoin STH whales fell into the red during the cryptocurrency’s decline in late September. But with the rally in the asset, the Unrealized P&L for the group has seen a sharp recovery into the positive region, rising to a high of $10.1 billion. The analyst notes that this is a cycle high for the metric.

Given the weak nature of the STHs, it’s possible that these massive profits may entice some of these whales into exiting the market here. It now remains to be seen whether enough demand will keep coming in to absorb any such potential profit-taking.

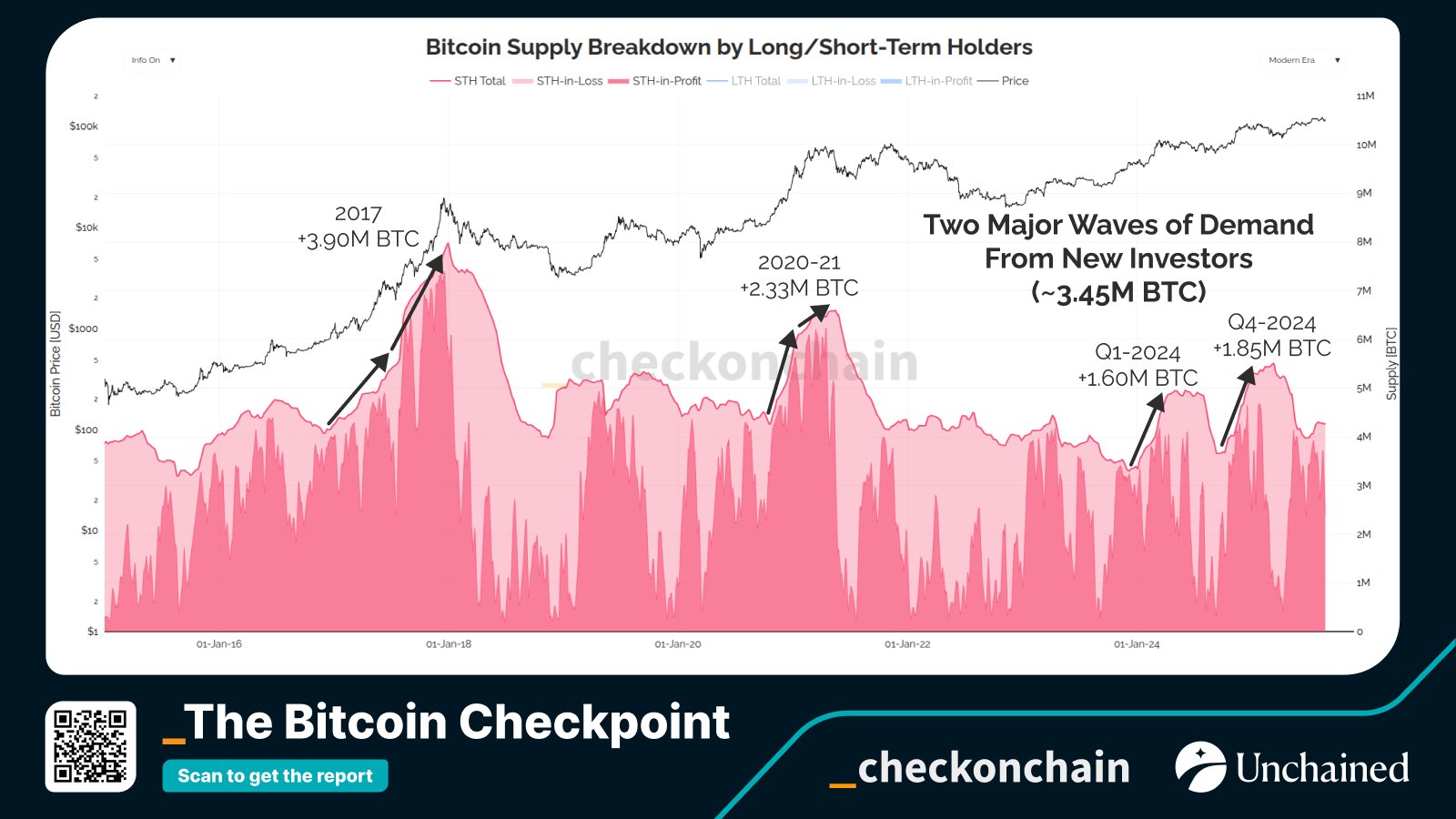

Speaking of the STHs, the current cycle has seen two large waves of coin transfer from the long-term holders (LTHs) to the STHs, as on-chain analysis suite Checkonchain has highlighted in an X post.

“3.45M BTC has shifted to Short-Term Holders this cycle, rivaling 2016–17 in scale but at 100x higher prices,” notes Checkonchain.

BTC Price

At the time of writing, Bitcoin is floating around $124,600, up around 11% over the last seven days.

3 months ago

11111

3 months ago

11111

English (US)

English (US)