The post Aster Crypto Price Surges as Mr. Beast Whale Move Fuels 9.8% Rebound appeared first on Coinpedia Fintech News

Aster has set crypto traders abuzz with a powerful price rebound, up 9.89% in one day and a striking 32.77% weekly gain. With its $3.17 billion market cap registering steady growth and a surge in both volume and onchain activity, Aster’s climb isn’t just about hype. It’s the result of a high-profile whale action, combined with platform fee milestones, and technical signals attracting both short-term traders and longer-term believers.

Whale Activity and Adoption Surge

Major players have made bold moves in the Aster ecosystem in the past 24 hours. Most notably, celebrity investor MrBeast, who purchased over 167,000 ASTER tokens, worth $305k. At the same time, as per Defillama, Aster’s daily fee haul is topping $14.3 million, more than Uniswap, and second only to Tether.

On September 29, its perpetual trading volume reached an eye-popping $42 billion, outpacing crypto trading heavyweights dYdX and GMX. The “Trade & Earn” model, delivering yield to users on their trading collateral, continues fueling platform adoption and token demand.

Aster Price Analysis

Aster’s 27% price drop from its all-time high near $2.43 found support at the $1.83 pivot, which is now a critical floor. The bounce to $1.97 signals that buyers are stepping in on dips. With the 7-day RSI at 69.56, there is momentum but not overheated conditions yet. The 7-day SMA at $1.94 forms the first test for bulls. A clear close above this level could reignite the Aster crypto price for an upside, with $2.12 and $2.37 as potential next targets.

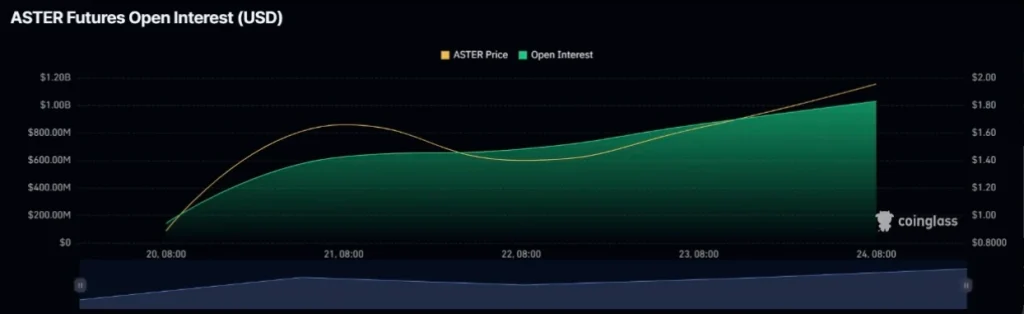

However, caution lingers: futures market outflows of nearly $140 million over seven days. This shows that some speculators are trimming positions after Aster’s huge rally. With an 8.8% token unlock approaching on October 17, holding above $1.83 will be key to maintaining market confidence.

Source: CoinGlass

Source: CoinGlassFAQs

Aster’s rally was sparked by large whale purchases and record daily protocol fees, signaling both influential backing and strong, real-world usage.

The crucial support is at $1.83, with resistance first at $1.94 and potential targets at $2.12 and $2.37 if momentum stays strong.

The sustainability depends on staying above $1.83 support, continuous fee generation, and monitoring October’s token unlock and whale movements.

3 months ago

79504

3 months ago

79504

English (US)

English (US)