Digital asset manager Grayscale has withdrawn its filing for an Ethereum futures exchange-traded fund (ETF), prompting traders to bet against Ether’s price performance in the near term.

Grayscale filed a 19b-4 application with the Securities and Exchange Commission (SEC) on September 19 last year to list an Ether futures ETF, and the regulator was set to decide on this application on May 30.

But the crypto asset manager is pulling back on the plan after filing a withdrawal notice with the SEC on May 7.

According to Bloomberg ETF analyst James Seyffart, Grayscale had initially filed for the Ethereum futures ETF as a “Trojan Horse” to force the SEC into approving its spot Ethereum ETF.

UPDATE This is interesting. @Grayscale just withdrew their 19b-4 filing for an #Ethereum futures ETF. This was essentially a trojan horse filing in my view, in order to create the same circumstances that allowed Grayscale to win the $GBTC lawsuit (approve futures deny spot) pic.twitter.com/Kihj2dlQx1

— James Seyffart (@JSeyff) May 7, 2024

If the SEC had approved Grayscale’s application for an Ethereum futures ETF, the asset manager would have grounds to sue the SEC for treating futures and spot ETFs differently if it denied its spot ETH ETF, as happened with its spot Bitcoin ETF.

“[I don’t know] why they’d do this honestly,” Seyffart said. “Maybe the SEC spoke with Grayscale about this…and whatever was said convinced Grayscale to withdraw?”

The SEC is set to decide on VanEck’s spot Ethereum ETF application on May 23, with analysts estimating there are very low odds of approval.

Crypto Traders Bet Against Ether

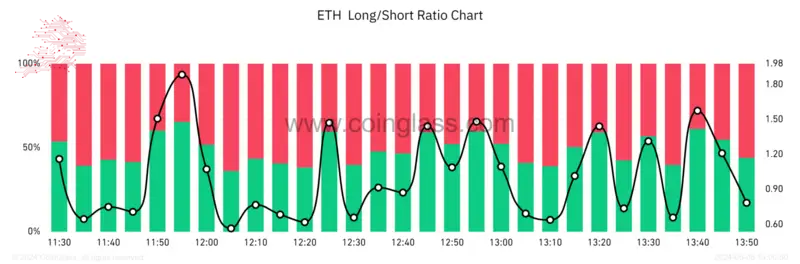

Data from Coinglass shows that short positions on Ether have surpassed long positions as traders anticipate Ether’s price drop.

(ETH Long/Short Ratio Chart. Source: Coinglass)

About 56% of Ether futures traders have taken a short position, while only 43% of traders are betting that the price will appreciate.

The negative trader sentiment comes as the market becomes pessimistic that the SEC will approve Ether spot ETFs. An investigation into the Ethereum Foundation by US regulators has also triggered concerns over whether ETH could be classified a security.

Ether was trading at $3,001 as of 07:01 a.m. EST according to CoinGecko.

Also Read:

- Ethereum Price Prediction: As Grayscale Pulls Its Ether Futures ETF, This Learn-To-Earn Crypto Offers A 1,533% Staking Reward

- SEC Chair Gary Gensler Grumbles About ”Small” Crypto Industry Getting ”Outsized” Media Attention Because Of Scams, Fraud

- Top 3 Presale Crypto Gems to Invest in Before May Ends – Dogeverse, Sealana, and 5th Scape

1 week ago

6361

1 week ago

6361

English (US)

English (US)