The post FOMC Minutes to Release Today: Here’s How Bitcoin Price Could React appeared first on Coinpedia Fintech News

The U.S. Federal Reserve is set to release the minutes from its December 10 FOMC meeting today, a macro event that could shape market direction well into early 2026. With Bitcoin tightly linked to macro signals, traders across crypto, gold, and equities are bracing for heightened volatility once the report goes live.

Historically, FOMC outcomes have leaned bearish for risk assets. Updated data shows that prices moved lower 75% of the time after FOMC meetings, while only 12.5% of cases saw prices move higher, with the remaining 12.5% showing no clear direction. This trend has made many traders cautious, especially with Bitcoin still stuck in a tight range.

FOMC Minutes to Clarify Fed’s Rate Cut Path

According to the CME FedWatch Tool, expectations around rate cuts remain mixed. The probability of a January rate cut is still low at around 16%, though slightly higher than earlier estimates. Markets are pricing in a 52% chance of a cut by March, while expectations for a second cut by July stand near 59%.

Looking further ahead, rate-cut expectations for 2026 have rebounded modestly, but they remain well below early December highs. Importantly, the Fed’s own dot plot suggests just 33 basis points of cuts on average for 2026, highlighting a more cautious, “wait-and-see” stance among policymakers.

The minutes are expected to shed light on internal disagreements within the Fed. While a 25-basis-point cut was delivered at the December meeting, officials remain divided over how quickly further easing should happen, especially with inflation and jobs data still sending mixed signals.

Why FOMC Minutes Matter for Bitcoin Price?

Bitcoin’s next move will largely depend on how the FOMC minutes are interpreted by the market. If the minutes signal that the Federal Reserve is leaning toward more rate cuts in 2026, the U.S. dollar is likely to weaken, risk appetite could improve, and capital may flow back into assets like Bitcoin, supporting a price recovery.

However, if the minutes reinforce a cautious or hawkish “wait-and-see” stance, the dollar could strengthen, risk sentiment may fade, and Bitcoin could come under renewed selling pressure. With BTC closely tied to macro conditions, the tone of these minutes could act as the catalyst that decides whether Bitcoin breaks higher or revisits lower support levels.

Bitcoin Price Outlook: Key Levels to Watch

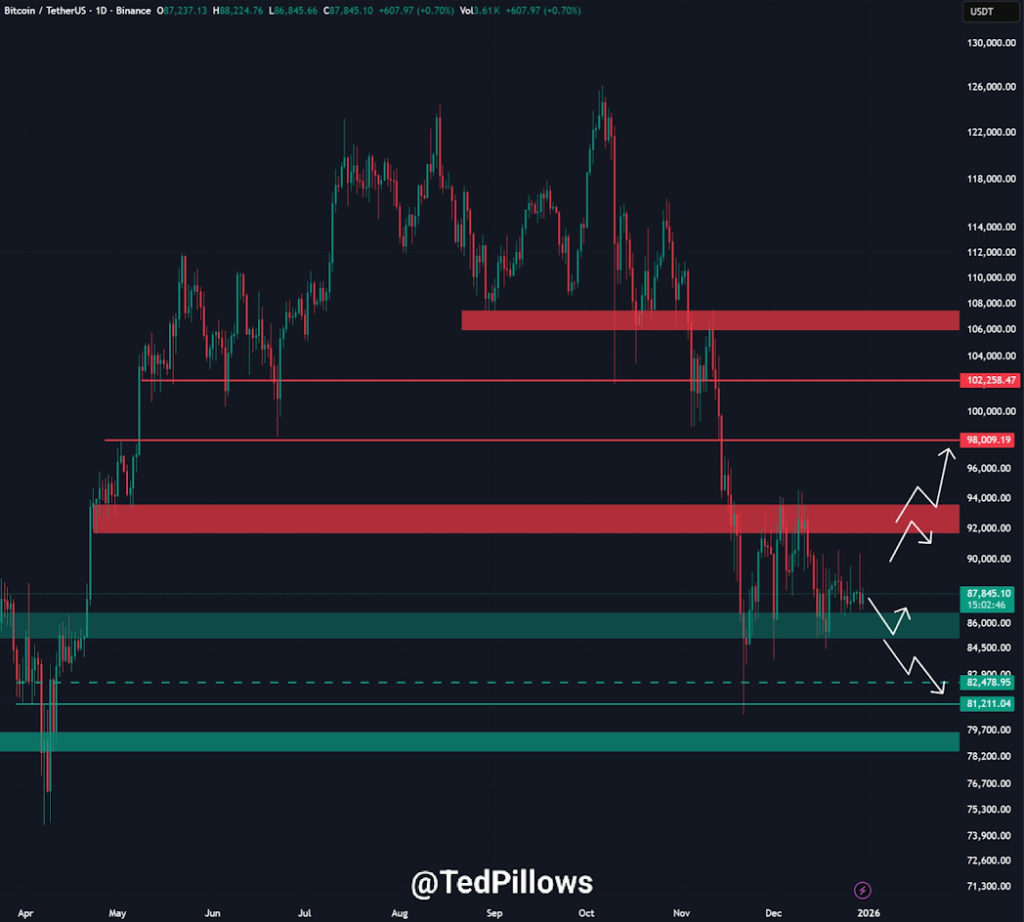

At present, Bitcoin is range-bound between $87,000 and $90,000, a structure that has held for over a month. Until BTC reclaims the $90,000 level, upside momentum remains capped.

- Bullish scenario: A clean break and acceptance above $90,000 could open the door to $95,000, and potentially a push toward six-figure levels if momentum builds.

- Bearish scenario: Losing the $87,000 support zone increases the likelihood of a drop toward $84,000–$85,000, a level that has acted as a key demand area since November.

Technically, Bitcoin is trading below important resistance near the anchored VWAP, with thin holiday liquidity amplifying moves. Equal lows around $86,690 remain a clear downside liquidity target, while the strongest upside setups appear only at range extremes.

What Comes Next

With liquidity expected to return after the holidays, today’s FOMC minutes could set the tone for Bitcoin’s first major trend of 2026. Until then, the market remains coiled, waiting for the Fed’s words to provide clarity on whether the next move breaks higher or slips lower.

1 hour ago

523

1 hour ago

523

English (US)

English (US)