The Bitcoin (BTC) derivatives market is witnessing a sharp reversal on Tuesday, December 9, with BTC funding rates dropping more than 71% in the last 24 hours, judging by CryptoQuant data on the same day. In other words, the number of leveraged long positions is going down as traders step back from excessive risk.

If the Bitcoin funding rate continues to slide, it could signal a deeper shift toward more bearish territory. Such conditions often culminate in volatility spikes as well, as even mild price pullbacks can trigger swift liquidation waves.

BTC derivatives overview. Source: CryptoQuant

BTC derivatives overview. Source: CryptoQuantThe BTC funding rate collapse also coincided with a modest 0.66% dip in Bitcoin’s open interest, suggesting that a small portion of leveraged long positions has already been flushed out.

Bitcoin funding rates drop ahead of key macro deadlines

The loss of optimism in Bitcoin follows the broader crypto market, which was nearly 2% in the red in the early hours due to fear regarding the Federal Reserve decision due tomorrow.

If the Fed adopts a more hawkish tone, a stronger dollar and tighter liquidity conditions could put more pressure on risk assets such as Bitcoin, prompting traders to unwind leveraged bets even further.

Considering Bitcoin’s technical picture was nothing to write home about either, the asset was shaky on all fronts, which further contributed to the fear.

Indeed, “digital gold” was trading at $90,410 at press time, down 1.28% on the day with a confirmed bear flag pattern threatening a correction toward the $70,000 area.

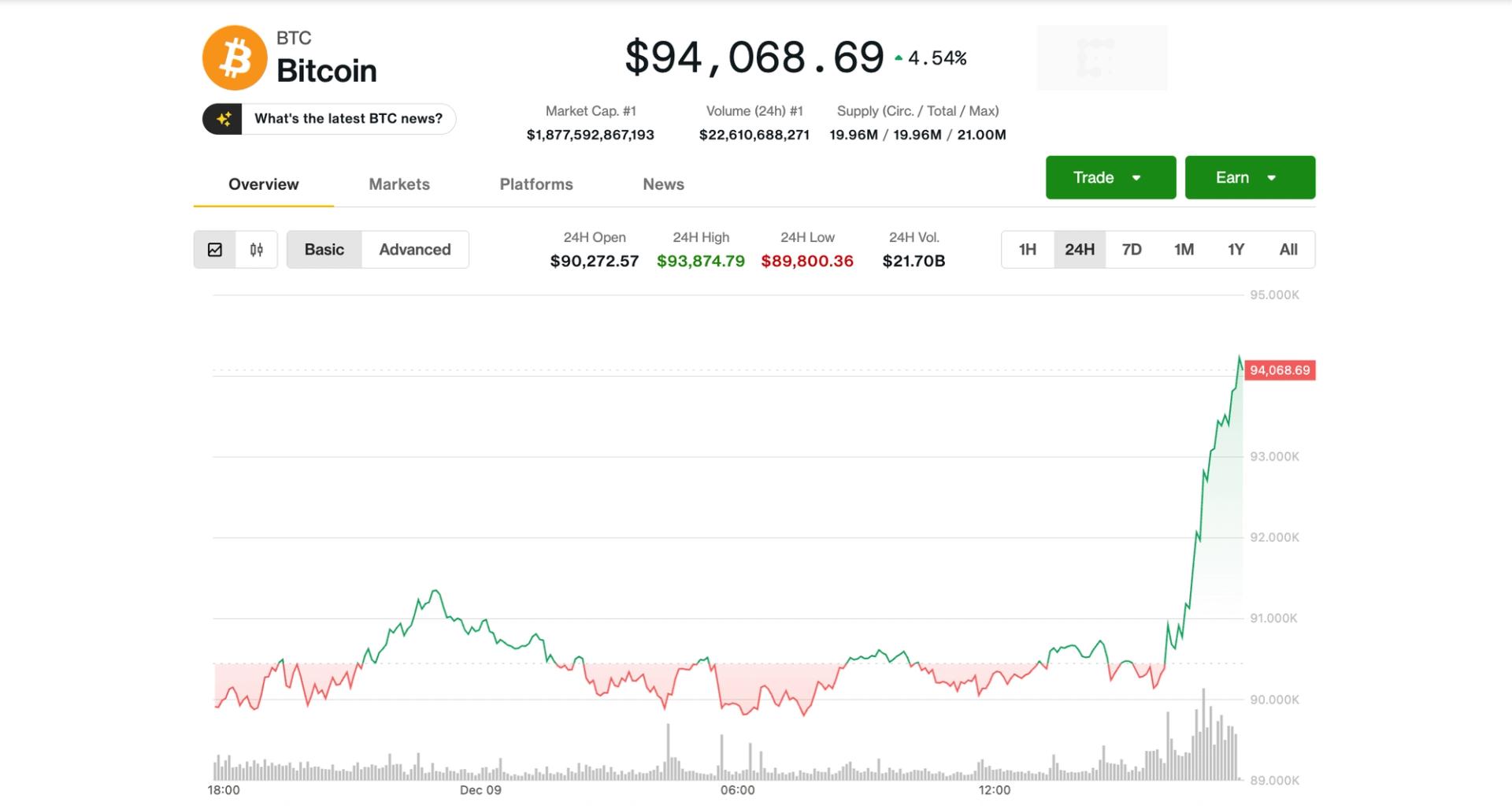

BTC one-day price chart. Source: Finbold

BTC one-day price chart. Source: FinboldThe ongoing Bitcoin funding rate slump thus reflects a combination of factors, the most notable being aggressive long unwinding and loss of speculative appetite ahead of key macro catalysts.

While certainly a bad omen at first glance, the setup still comes with a potential silver lining, as it could set the stage for a more stable market structure in the short term once the dust has settled. Similar scenarios have already played out in August and October this year.

Accordingly, traders will be monitoring whether the cooling leverage environment leads to consolidation or whether renewed volatility emerges as futures markets reset.

Featured image via Shutterstock

The post Bitcoin funding rate crash 70% in a day; Here’s what it means appeared first on Finbold.

2 hours ago

385

2 hours ago

385

English (US)

English (US)